The Bank of Canada delivered an expected 25 basis point rate cut today, lowering the overnight rate to 2.25%—the bottom of the neutral range that would not add to or subtract from inflation pressures over time.

Beyond the rate cut itself, two themes stood out from today’s announcement. First, the Bank adopted a clear holding bias, stating that “Governing Council sees the current policy rate at about the right level” assuming future economic and inflation data evolve largely in line with current projections.

Second, the Bank emphasized concerns about structural economic damage from trade disruptions, reducing the effectiveness of monetary policy as a tool in addressing weakening demand while maintaining inflation control.

Overall, our base case assumes no further rate reductions, as we expect a ramp up in fiscal stimulus (with more details to come in the federal budget next week) will do the bulk of the heavy lifting in the policy response to address tariff-related, concentrated economic weakness.

The BoC’s latest baseline economy projections are in line with ours

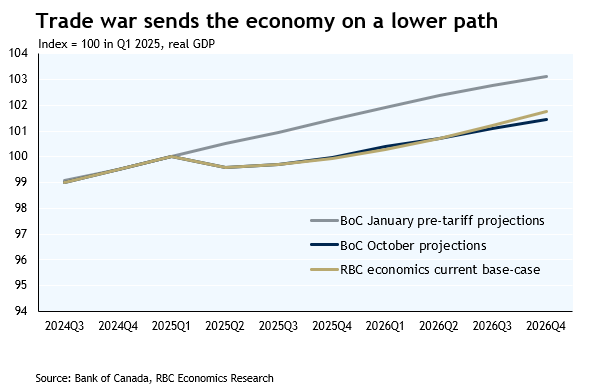

The BoC’s guidance that the overnight rate is not expected to be reduced further is contingent on the economic outlook evolving in line with their base case projections that were the first since January. The Bank had resorted to scenario analysis in April and July due to volatile U.S. trade policy.

The Bank’s overarching assumption behind the projections is that current tariff measures will remain in place. Key estimates regarding these measures—including a roughly 6% average effective tariff rate imposed by the U.S. on Canadian exports, with the majority of exports remaining exempt due to CUSMA compliance—align directly with our own analysis.

As a result, there is substantial alignment between our forecasts and the central bank’s outlook. Both anticipate slow but positive growth in the Canadian economy through the second half of this year, followed by moderate acceleration in 2026 as trade related uncertainty starts to fade.

Headline inflation is expected to remain close to the 2% target over the forecast horizon. However, we see upside risks to this baseline projection primarily from robust domestic demand, given household spending that has broadly held on to resilience to-date and expectation that weakening in the labour market could be drawing to an end.

The Bank of Canada anticipates upside risks mainly from trade-related factors, such as larger-than-expected cost increases from tariffs or sudden reductions in sectoral tariffs.

It see downside risks to the inflation projections from softer than expected domestic demand, or a sudden tightening in global financial conditions sparked by a correction in AI related stock market valuations that have been tied to resilient growth in the U.S. economy this year.

BoC expects lasting structural damage to the economy from the trade shock

Beyond this cycle, the Bank of Canada expects structural damage from ongoing trade disruptions. Combined with slower population growth, Canada’s potential output is expected to expand at a reduced rate of 1.6% in 2025 and 1.0% in 2026, before recovering slightly to 1.3% in 2027.

This structural damage will reduce the productive capacity of the Canadian economy and erode the effectiveness of monetary policy. In simple terms, as the economy’s capacity shrinks, it will become increasingly difficult for the Bank of Canada to lower interest rates to stimulate demand without risking that demand will exceed what the economy can produce, thereby causing inflation.

This highlights the urgency for fiscal policy to step up by helping expand the economy’s capacity limits—a priority we expect will account for the bulk of new spending to be announced at the fall budget update on November 4.