- The USD index’s peak began with the dollar itself, but the pound helped it along.

- The RBA may raise rates, while Japan may intervene in the forex market.

As soon as the US dollar weakened, its competitors immediately stiffened their resolve. The pound rose due to the markets’ acceptance of Rachel Reeves’ draft budget, the yen rose following the government’s strongest verbal interventions, the Australian dollar rose amid speculation about a key rate hike by the Reserve Bank, and the euro rose on hopes for a resolution to the Ukrainian conflict. However, the foundation for the decline was laid by the dollar itself.

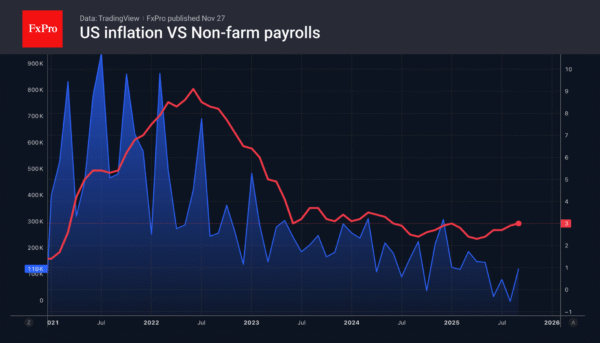

Dovish rhetoric from influential Fed officials, a series of disappointing economic data, and the Hassett factor triggered a sell-off of the dollar. New York Fed President John Williams, San Francisco Fed President Mary Daly, and their FOMC colleague Christopher Waller are inclined to cut the federal funds rate in December. In their view, the risks of a cooling labour market outweigh the risks of accelerating inflation.

Data support this view. ADP reports a decline in private sector employment, while another report on repeat applications for unemployment benefits has returned to a four-year high. Concerns about the fate of the labour market are forcing Americans to tighten their belts. As a result, the chances of the Fed cutting rates in December jumped to 85%, triggering a fall in the dollar.

The pound’s reaction to tax increases in Britain accelerated the decline. Rachel Reeves plans to increase budget revenues by targeting wealthy individuals, as well as expensive real estate and investments. The markets reacted calmly to this approach, and GBPUSD continued to strengthen. The OBR’s upward revision of its economic forecast from 1% to 1.5% may cause the Bank of England to question the need for a rate cut in December.

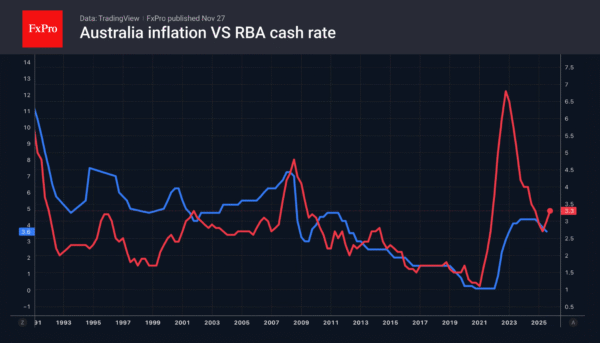

Down under in Australia, inflation accelerating to 3.3% in October may force the RBA to raise rates. The annual CPI growth rate exceeded not only experts’ forecasts, but also the upper limit of the Reserve Bank’s target range of 2-3%. As a result, some investment banks began to argue that the next step would be to tighten monetary policy. AUDUSD responded with growth.

Meanwhile, Finance Minister Satsuki Katayama stated that an agreement has been reached between the US and Japan regarding currency intervention, which allows the government to seriously consider intervening in the Forex market if the USDJPY rally persists.