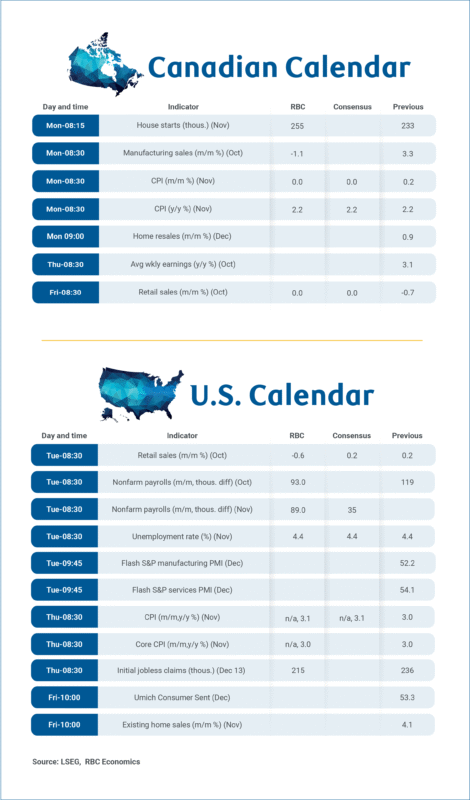

A busy week of key data releases ahead of the holidays includes Canadian inflation, housing, and employment, while the U.S. will see delayed releases on jobs and inflation.

Canada’s inflation on Monday is expected to have held steady in November with growth in the headline Consumer Price Index remaining at 2.2%, unchanged from October after slowing from 2.4% in September. Gasoline prices rose moderately in November, but were still about 8% below a year ago, thanks to the end of consumer carbon surcharges in April. That leaves energy inflation tracking well below zero.

Food prices, on the other hand, likely continued to grow faster year-over-year, at above 3%, consistent with rising agricultural commodity prices over the first half of 2025.

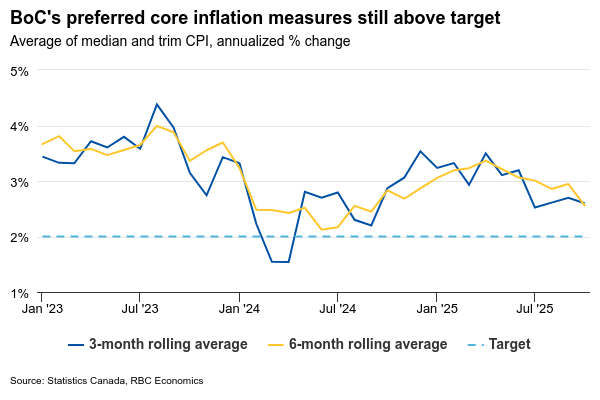

Excluding food and energy, we look for inflation to have held steady at 2.7%. Annual growth in the Bank of Canada’s core measures—CPI trim and CPI median—is likely to tick lower but will stay close to the upper end of the 1% to 3% target range for inflation.

We continue to expect no additional BoC rate cuts in the year ahead with underlying inflation persistently above target and economic conditions improving.

Reductions of 275 basis points since mid-2024 should lead to gradual improvements in home resales into 2026. Regional details show more divergence than usual, but abundant supply in key markets means it will likely take a while for prices to start rising.

On Thursday, we’ll watch the Survey of Employment, Payrolls and Hours (SEPH) closely for contradicting signs to the consecutive employment increases in the Labour Force Survey (LFS). As of September, employment in SEPH was essentially unchanged versus a 228,000 increase (excluding self-employed workers) in the LFS.

Job vacancies from SEPH already ticked higher in September, and we expect that persisted in October, following increases in Indeed job postings.

More clarity on U.S. jobs and inflation post shutdown

We’ll get the long overdue U.S. inflation for November, and labour market reports for October/November for a glimpse of the state of the economy right after the prolonged government shutdown. Our forecast expects little deterioration in labour conditions or inflation over that period.

Payrolls on Tuesday are expected to show roughly 90,000 per month growth in October and November and the unemployment rate is expected to have held at 4.4% in November, unchanged from September.

On Thursday, we look for core U.S. CPI unchanged at 3% year-over-year from September, while headline measure ticked slightly higher to 3.1%, driven by slight accelerations in food and energy prices.

The Federal Reserve sounded cautious about whether additional interest rate cuts would be needed after a 25-basis-point cut in December. If the data broadly evolves as we expect, we think the Fed will deliver just one more 25-basis-point cut in January before pausing for the rest of 2026.

The October surveys that produce the unemployment rate and CPI data were unable to be collected by the Bureau of Labour Statistics during the shutdown, and will not be released.