- The Bank of England cut the Bank Rate to 3.75%.

- The vote split was 5-4, as expected.

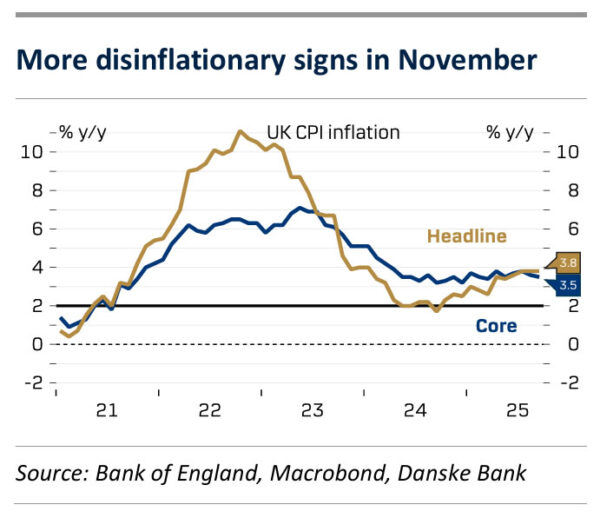

- The potential of further easing hinges a lot on the continuance of the recent promising disinflation.

- The market reacted by trading EUR/GBP lower and Gilt yields a bit higher.

- We continue to expect one final rate cut to 3.5% in April.

The Bank of England (BoE) cut the Bank rate by 25bp to 3.75% in line with our expectation and market pricing. The vote split was 5-4 (cut vs. keep), which was also in line with consensus. The meeting was one of the small ones and thus included no new economic outlook.

Following the soft November inflation print yesterday, there was a chance of a bigger majority voting for a rate cut, which would have been a dovish sign. Deputy governor Lombardelli would have been the most obvious candidate, but she continued to vote for keep. The four dissenters (Lombardelli, Greene, Mann and Pill) refer to continued too high wage pressures and are not convinced that the monetary policy stance is meaningfully restrictive. That said, they acknowledge the recent progress in disinflation and Greene explicitly states that she believes inflation risks have shifted to the downside. Thus, while the MPC remains split, the hawkish voters have become less hawkish since the November meeting. Governor Bailey’s remarks are quite balanced, and he and deputy governor Breeden (most neutral leaning voters) highlight that more disinflationary signs are needed to cut rates further.

BoE call. We think Governor Bailey will take a cautious approach and listen to both the dovish and the hawkish camp when timing the next rate cut and that a majority will vote for a final rate cut at the April meeting.

Market reaction. Gilt yields traded a couple of basis points higher, and EUR/GBP lower as the chance of a more dovish cut was priced in ahead of the meeting.·