- Yen falls sharply on reports PM Takaichi is planning election.

- The slide triggers fresh intervention warnings.

- Investors push back their BoJ rate hike bets.

- Intervention alone may not be enough to save the day.

Yen accelerates downtrend amid Japan election jitters

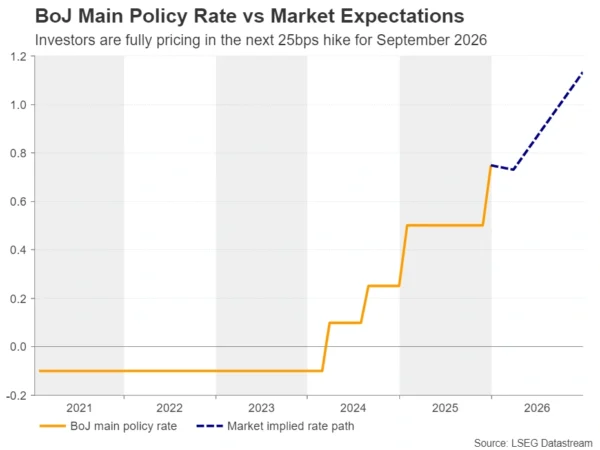

Bank of Japan policymakers left 2025 wearing their hawkish suits after they raised interest rates to the highest level in three decades and signaled willingness to take them even higher. However, the Japanese yen was not able to capitalize on the Bank’s hawkish decision, perhaps as traders wanted more specific clues as to when officials were planning to hit the hike button next.

To make things even worse, the yen accelerated its downfall to territories last seen back in July 2024 after Kyodo News reported that Prime Minister Sanae Takaichi has told a senior member of the Liberal Democratic Party that she is thinking about calling a snap election in February.

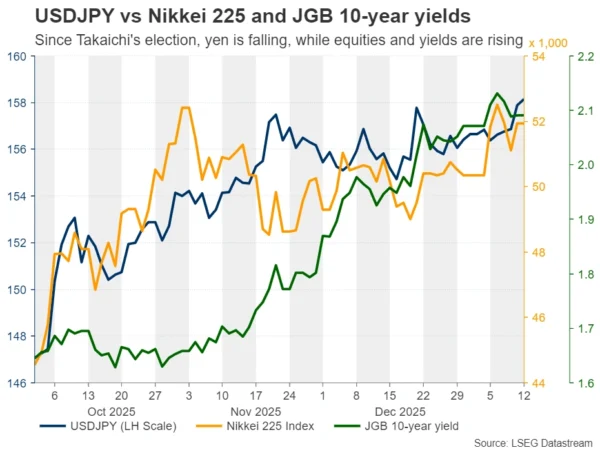

With an approval rating of around 70%, she may be confident about a victory that will allow her to proceed more freely with her spending plans, which would add to the already ballooned government debt. That’s maybe why the yen is tumbling, while equities and Japanese Government Bond (JGB) yields are skyrocketing. This is the so-called “Takaichi trade” and may be intensified should the scenario of the LDP securing a single-party majority becomes even more likely.

Besides the prospect of a piling debt, what is also driving the yen lower may be expectations that the BoJ’s hands will be tied ahead of the election. The next interest rate hike may be delivered after the spring wage negotiations, and only if the negotiations result in satisfying salary increases.

Yen tumble reignites intervention talk

However, with dollar/yen headed towards the psychological zone of 160.00 again, the intervention discussion is back on the table. Finance Minister Satsuki Katayama said at a meeting with US Treasury Secretary Scott Bessent that she remains concerned about the “one-way weakening of the yen,” with Bessent sharing those concerns and calling for the BoJ to raise interest rates.

Katayama warned about intervention back in December, when dollar/yen emerged above 157.00, noting that Japan has a “free hand” to take action. Maybe she met with Bessent to get the green light, which means that an intervention episode near the 160.00 zone is more likely than previously thought.

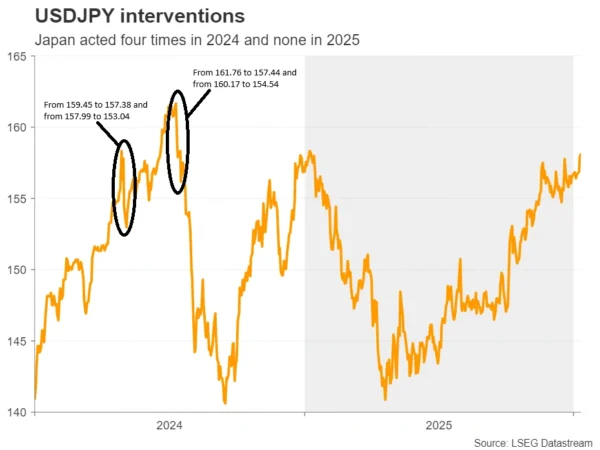

However, even the new warning was not enough to stop the yen’s bleeding, which raises the question whether actual action could do the work. In 2024, Japanese authorities stepped into the market to prop up the yen four times, twice in April and twice in July. In April, the impact was temporary, with the yen soon resuming its slide. In July, the effect was more meaningful, with dollar/yen falling from around 162.00 to below 140.00 by September. The difference is that in the second case, the intervention actions were followed by a BoJ rate hike.

Will a possible election delay BoJ rate hikes?

Therefore, with Takaichi planning to increase spending and thereby pile up more debt, any intervention episode could also have limited and short-lived impact. A BoJ rate hike may also be needed, as a weaker yen could fuel inflation through higher export costs; and this could eventually weigh on economic growth.

Currently, according to Japan’s Overnight Index Swaps market (OIS), a 25bps rate hike is not fully pencilled in until September and if the Bank is indeed not planning to act soon, the yen is likely to continue suffering, with intervention not being able to change its fate. Yields are likely to continue rallying, as fewer investors will be willing to finance Japan’s ballooning debt. However, equities are unlikely to continue cheering Takaichi’s spending plans indefinitely. At some point, worries about inflation and economic slowdown could prompt investors to abandon Japanese stocks as well, in a so-called “Sell Japan” episode.

Therefore, unless the Finance Ministry decides to intervene and the BoJ to hike interest rates soon, the yen may be destined to extend its downtrend, and dollar yen may easily find itself trading above 160.00 soon.

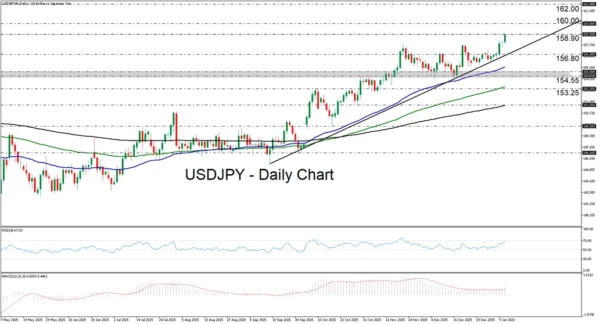

Dollar/Yen may extend uptrend even after intervention

From a technical standpoint, dollar/yen is currently flirting with the 158.90 resistance, marked by the peak of January 10, 2025, where a clear close higher could encourage a test at the round figure of 160.00. The prevailing uptrend remains intact as marked by the uptrend line drawn from the low of September 17. A break above 160.00 could pave the way towards the high of July 3, 2024, at around 162.00. For a bearish reversal to start being considered, a decisive break below the 154.55 zone may be needed.