Here are the latest developments in global markets:

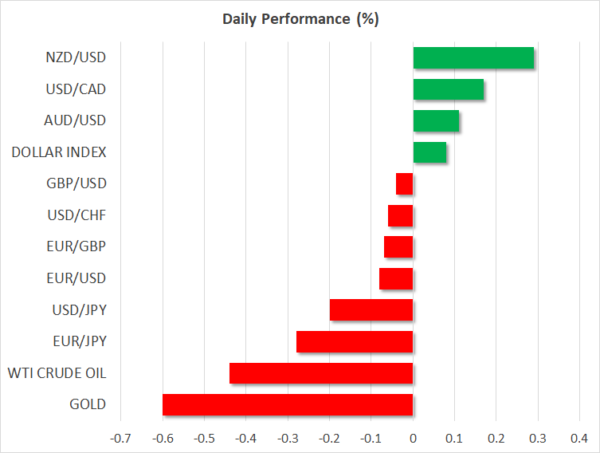

FOREX: The dollar was slightly higher versus a basket of currencies, recovering from losses recorded earlier in the day – the dollar index rose back above the 90 level. Dollar/yen was 0.2% lower at 106.55 amid a suspected cronyism scandal in Japan implicating Finance Minister Taro Aso. Euro/dollar and pound/dollar were little changed in anticipation of fresh catalysts. The aussie and the kiwi remained elevated versus their US counterpart, though they gave up on a significant part of earlier gains that saw them rise to two-week high levels. Ausie/dollar and kiwi/dollar were up by 0.1% and 0.3% respectively, being supported in part by positive risk sentiment on the back of abating worries over a trade war occurring.

STOCKS: European equities were broadly in the green, though gains were limited for the most part. The pan-European Stoxx 600 that more widely gauges equity performance in the continent was up by 0.3% at 1145 GMT, rising to 380.11 earlier in the day, its highest since February 28. The blue-chip Euro Stoxx 50 traded higher by 0.5%. Leading German utility companies announcing an overhaul in the sector boosted sentiment and contributed to the rise in equities; utilities were the leading gainer within the Stoxx 600. The German DAX outperformed relative to other blue-chip European indices, being up by 0.6%. The UK’s FTSE 100 was the only major European benchmark that was trading lower, being weighed by lower commodity stocks, albeit its losses were marginal. Meanwhile, the French CAC 40 was up by 0.2%. The Stoxx Europe 600 Automobiles and Parts sub-index traded higher by 0.5% despite a tweet by US President Donald Trump in which he threatened to impose taxes on European vehicles imported into the US in case the EU retaliates in response to his administration’s decision to proceed with the imposition of tariffs on steel. German carmaker Volkswagen (up 1.1%) was among the sub-index’s lead gainers. Futures on the Dow, S&P 500 and Nasdaq 100 were higher by 0.3%, 0.3% and 0.5% respectively, pointing to a higher open on Wall Street.

COMMODITIES: WTI and Brent crude were giving up part of Friday’s gains that saw them close the day higher by around 3.0%; the rise came on the back of a decrease in the number of US oil rig counts for the first time in seven weeks and improved risk sentiment following stronger-than-expected jobs growth figures out of the US. Expectations, though, that US output will eventually rise in 2018 are exerting pressure on prices, with WTI and Brent crude trading lower on Monday by 0.45% and 0.6% at $61.76 and $65.10 per barrel respectively. Gold was 0.6% lower at $1,316.06. This compares to Friday’s 11-day low of $1,312.99 that came on the back of rising appetite for risk and acting to the detriment of the perceived safe-haven’s allure.

Day ahead: In the absence of data focus falls on rest of the week

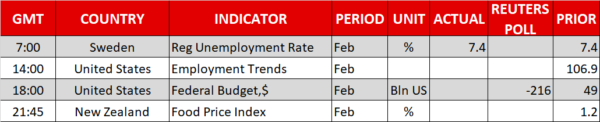

Monday’s economic calendar seems to be lacking traditional market moving releases. Consequently, market participants’ attention is falling on upcoming releases, such as Tuesday’s inflation figures for the month of February out of the US, for positioning moving forward.

In the absence of other releases, the Conference Board’s employment trends index for February, as well as data on the US Federal Budget for the same month scheduled to go public at 1400 GMT and 1800 GMT respectively might attract some interest.

A meeting of eurozone finance ministers is taking place today. While typically such meeting are not market movers, the fact the current one is taking place in the aftermath of the Trump administration’s decision to impose tariffs on imported steel and aluminum could render any remarks on trade of importance. Any comments on the exchange rate are likely to generate attention as well.

In equities, companies continue to release quarterly results though overall sentiment is expected to be continued to be driven by developments on trade or any breakthrough on the political front, for example in relation to the Italian elections held in early March or the upcoming meeting between Trump and North Korea’s Kim Jong Un.