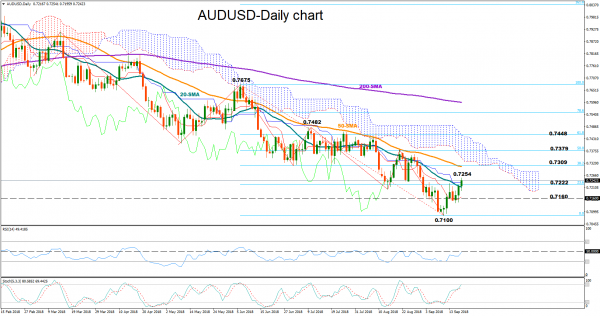

AUDUSD continues to attract buying interest for the third consecutive day, crawling up to 0.7254 early on Wednesday, the highest since the end of August. The RSI improved further but is still below its 50 neutral mark, a sign that negative risks are still in the background, while Stochastics support that the rally is overdone and bearish corrections are possible as the red %D line and the green %K line approach the overbought threshold of 80.

An extension to the upside may pause around the 38.2% Fibonacci retracement of the downleg from 0.7675 to 0.7100, near 0.7309 which acted as a barrier to downside movements in July. Slightly higher, the 50% Fibonacci of 0.7379 which coincides with the peak on August 21, could come under the radar as well, while the area between the 61.8% Fibonacci of 0.7448 and July’s high of 0.7482 may attract a greater attention as any decisive close above this zone would clearly violate the long-term downtrend. The latter would also pierce the Ichimoku cloud, signaling further bullish moves.

On the other hand, if the pair loses ground, traders will look for immediate support around 0.7222, the 23.6% Fibonacci. Even lower, the 0.7160 and 0.7144 marks taken from the lows on May and December 2016 respectively could come into view before bearish moves strengthen towards the 0.71 psychological level.

Turning to the bigger picture, the outlook holds bearish, with the price printing lower lows and lower highs since the end of January. The 50-day and the 200-day simple moving averages maintain a negative slope, signaling that the negative picture is likely to stay for longer.

To summarize, the short-term bias is skewed to the downside, while in the long-term, AUDUSD maintains a clear bearish outlook.