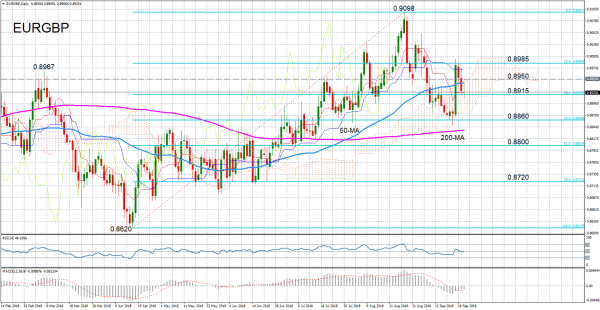

EURGBP has retreated significantly from the more than one-year high of 0.9098 touched at the end of August and appears once again to be struggling for direction. Prices have been drifting inside the Ichimoku cloud during the past couple of weeks and a brief overshoot following the rebound on the 50% Fibonacci retracement of the upleg from 0.8620 to 0.9098 proved unsustainable.

A continuation of the sideways movement risks eroding the bullish medium-term structure and restoring the neutral outlook that had prevailed until July/August. In the more near-term, technical indicators point to a neutral bias. The RSI has flatlined near 50, while the MACD histogram is also moving sideways. However, with both in negative territory, the short-term risk is to the downside.

Immediate support is being provided by the 38.2% Fibonacci retracement at around 0.8915, which is just below the Tenkan-sen line. A break below this level would push prices back towards the key 50% Fibonacci, near 0.8860. A drop below the 50% Fibonacci would deepen the bearish pressure and bring the 61.8% Fibonacci level into focus at the 0.88 handle.

However, should support at the 38.2% Fibonacci hold, an upside reversal would see the top of the Ichimoku cloud around 0.8950 acting as immediate resistance. A break above the cloud could lead to a retest of the 23.6% Fibonacci barrier at 0.8985, which capped last Friday’s strong rebound. A successful climb above this level would open the way to August’s 11½-month top of 0.9098.