Key Highlights

- The Aussie Dollar started a downside move after it failed near 0.7150 against the US Dollar.

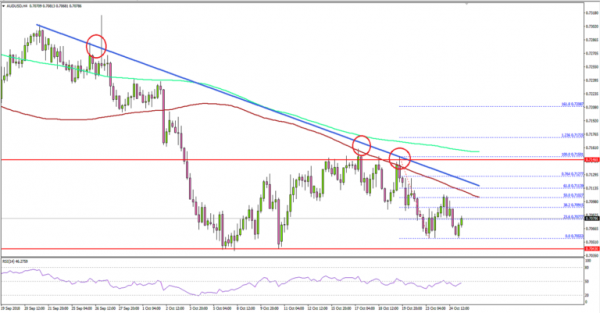

- There is a major bearish trend line in place with resistance at 0.7115 on the 4-hours chart of AUD/USD.

- The US Manufacturing PMI for Oct 2018 (Preliminary) increased from 55.6 to 55.9.

- Today, the Durable Goods Orders for Sep 2018 will be released, which is forecasted to decline 0.9%.

AUDUSD Technical Analysis

The Aussie Dollar failed on many occasions near the 0.7150 resistance against the US Dollar. The AUD/USD pair declined and broke the 0.7100 support area.

Looking at the 4-hours chart, the pair traded as low as 0.7055 recently and settled below the 100 simple moving average (red, 4-hours). Later, there was an upside recovery and the pair tested the 50% Fib retracement level of the last slide from the 0.7150 high to 0.7055 low.

However, there are many hurdles on the upside near the 0.7110 and 0.7120 levels. Moreover, there is a major bearish trend line in place with resistance at 0.7115 on the same chart.

Therefore, a break above the trend line and the 0.7150 resistance is needed for a decent recovery in AUD/USD. If not, the pair remains at a risk of more losses below the recent low at 0.7055 and the 0.7040 support.

Fundamentally, the US Manufacturing PMI reading for Oct 2018 (Preliminary) was released by the Markit Economics. The market was looking for a decline from the last reading of 55.6 to 55.5.

The result was positive as the US Manufacturing PMI increased from the last reading of 55.6 to 55.9, resulting in more gains in the US Dollar.

Looking at EURUSD, the pair declined below the 1.1430 support area, and GBP/USD traded to a new monthly low below the 1.2950 level to move further into a bearish zone.

Economic Releases to Watch Today

- German IFO Business Climate Index for Oct 2018 – Forecast 103.0, versus 103.7 previous.

- Germany’s GfK Consumer Confidence for Nov 2018 – Forecast 10.5, versus 10.6 previous.

- US Initial Jobless Claims – Forecast 214K, versus 210K previous.

- US Durable Goods Orders for Sep 2018 – Forecast -0.9% versus +4.5% previous.

- US Pending Home Sales for Sep 2018 (MoM) – Forecast -0.1%, versus -1.8% previous.

- ECB Interest Rate Decision – Forecast 0%, versus 0% previous.