Key Highlights

- The US Dollar traded higher recently and broke the 1.3400 resistance against the Canadian Dollar.

- There is a major bullish trend line formed with support at 1.3420 on the 4-hours chart of USD/CAD.

- The Canadian CPI increased 1.7% in Nov 2018 (YoY), less than the forecast of 1.8%.

- Today, the US Initial Jobless Claims will be released, which is forecasted to increase from 206K to 216K.

USDCAD Technical Analysis

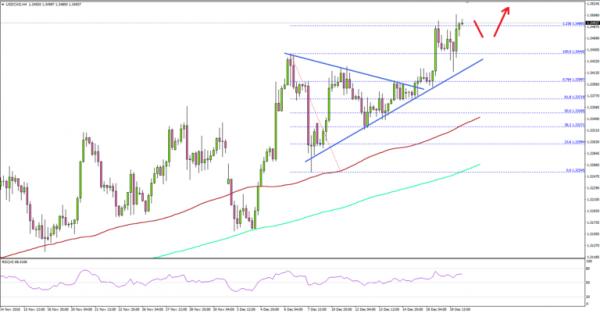

The US Dollar started a major bullish wave from the 1.3120 support against the Canadian Dollar. The USD/CAD pair traded above the 1.3400 resistance and it remains supported on dips if there is a downside correction.

Looking at the 4-hours chart, the pair recently broke a connecting bearish trend line at 1.3390 and traded above 1.3440. It traded towards the 1.3500 level and tested the 1.236 Fib extension level of the last decline from the 1.3445 high to 1.3254 low.

On the upside, a proper break and close above 1.3500 could trigger more gains. The next stop for buyers could be 1.3560, which is near the 1.618 Fib extension level of the last decline from the 1.3445 high to 1.3254 low.

On the downside, there are many supports near the 1.3400 level. Moreover, there is a major bullish trend line formed with support at 1.3420 on the same chart. Should there be a break below 1.3400, the pair may test the 1.3340 support and the 100 simple moving average (4-hours).

Fundamentally, the Canadian CPI figure for Nov 2018 was released by the Statistics Canada. The market was looking for an increase of 1.8% in the CPI in Nov 2018 compared with the same month a year ago.

The result was lower than the forecast, as the CPI increased 1.7% in Nov 2018. The monthly change was -0.4%, similar to the forecast. The monthly Core CPI increased 0.1%, less than the last 0.3%. The report stated that:

Energy costs declined 1.3% compared with November 2017, following a year-over-year increase (+7.9%) in October. Gasoline prices fell 5.4% year over year, as declining global crude oil prices led to lower prices at the pump and the first 12-month decrease in the gasoline index since June 2017.

Overall, USD/CAD remains well supported on dips near 1.3400 and 1.3340, and it may continue to move higher in the near term.

Economic Releases to Watch Today

- UK Retail Sales for Nov 2018 (YoY) – Forecast +1.9%, versus +2.2% previous.

- UK Retail Sales for Nov 2018 (MoM) – Forecast -+0.3%, versus -0.5% previous.

- UK Retail Sales ex-fuel for Nov 2018 (YoY) – Forecast +2.3% versus +2.7% previous.

- BoE Interest Rate Decision – Forecast 0.75%, versus 0.75% previous.

- US Initial Jobless Claims – Forecast 216K, versus 206K previous.

- Canada’s ADP Employment Change Nov 2018 – Forecast -18.0K, versus -23.0K previous.