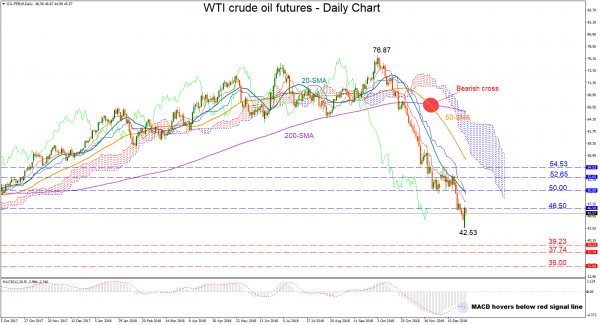

WTI crude oil futures (for February delivery) jumped by 9% on Wednesday after extending the steep slippery slope to a 1 ½-year low of 42.53. On Thursday, though, the market resumed its bearish mode, with the technical indicators suggesting that there are still some sellers that could hold the market on the downside in the short-term; the MACD consolidates below its red signal line, while the Tenkan-sen line continues to lose ground below the blue Kijun-sen line.

The 42.53 bottom could be challenged by the bears once again if the market deteriorates. In case it fails to halt downside movements this time, turning the outlook even more negative, attention will shift down to the 39.23-37.74 region where the price found support in previous years. Lower, the next stop could be near the 35 psychological level.

On the upside, nearby resistance is expected to come around 46.50, while a stronger wall could be met at the 50 level, where the 20-day simple moving average (MA) is currently lying. Additional gains may drive the price up to 52.65 before the door opens for the 54.53 barrier.

Looking at the bigger picture, the market is under severe pressure, and with the 50-day MA distancing itself below the 200-day MA, the negative profile is not expected to change anytime soon.