Key Highlights

- The US Dollar found support near 110.75 and rebounded against the Japanese Yen.

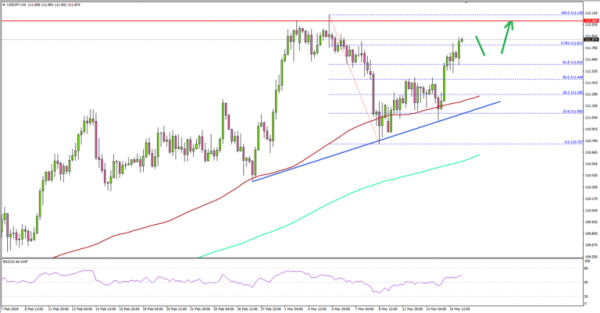

- A major bullish trend line is formed with support at 111.15 on the 4-hour chart of USD/JPY.

- The US Initial Jobless Claims for the week ending March 19, 2019 increased from 223K o 229K.

- The US Industrial Production report for Feb 2019 will be released today, which may rise 0.4% (MoM).

USDJPY Technical Analysis

After a major decline from the 112.13 high, the US Dollar found support near 110.75 against the Japanese Yen. The USD/JPY pair corrected higher above 111.20 and it seems to be following a bullish path.

Looking at the 4-hours chart, the pair gained traction this week and climbed above the 111.00 resistance. There was even a close above 111.15 and the 100 simple moving average (red, 4-hours).

The pair recently traded above the 50% Fib retracement level of the last decline from the 112.13 high to 110.75 low, which is a positive sign. On the upside, the main resistance is near the 112.00 level, above which the pair could climb above the 112.13 high.

The next key resistances are 112.40 and 112.65. On the downside, there are many supports above 111.00. There is also a major bullish trend line is formed with support at 111.15.

If USD/JPY declines below the trend line and the 100 SMA, there could be a sharp bearish reaction below the 111.00 and 110.75 support levels. The next main support is at 110.60, followed by 111.40.

Fundamentally, the US Initial Jobless Claims figure for the week ending March 19, 2019 was released by the US Department of Labor. The market was looking for a minor increase in claims from 223K to 225K.

The result was lower than the forecast as the US Initial Jobless Claims increased from 223K to 229K. The 4-week moving average came in at 223,750, down 2,500 from the previous week’s unrevised average of 226,250.

The report added that:

The advance number for seasonally adjusted insured unemployment during the week ending March 2 was 1,776,000, an increase of 18,000 from the previous week’s revised level. The previous week’s level was revised up 3,000 from 1,755,000 to 1,758,000.

In the short term, the US Dollar could correct lower, but USD/JPY seems to be well supported on the downside near 111.15 and 111.10.

Economic Releases to Watch Today

- Euro Zone CPI for Feb 2019 (YoY) – Forecast +1.5%, versus 1.5% previous.

- Euro Zone CPI for Feb 2019 (MoM) – Forecast +0.3%, versus -1.0% previous.

- US Industrial Production Feb 2019 (MoM) – Forecast +0.4%, versus -0.6% previous.