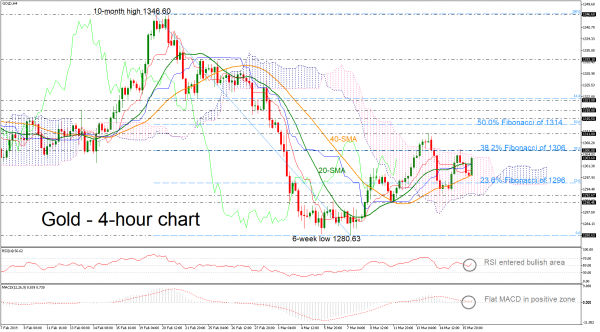

Gold is posting notable gains over the last 4-hour session, successfully surpassing its 20- and 40-simple moving averages (SMAs). While the price continues to trade within the Ichimoku cloud over the last week and the MACD oscillator keeps lacking momentum around its trigger and zero lines, the RSI is trying to frame a more positive picture for the short term as the indicator has started to slope to the upside again above its 50 neutral mark.

Immediate resistance would likely come from the 1306 barrier, which coincides with the 38.2% Fibonacci of the downward movement from 1346.60 to 1280.63. Rising above this area would help shift the focus up to 1311. Breaking this level too, the investors could look next at the 50.0% Fibonacci of 1314 and the 1315.50 resistance.

Should prices reverse lower, immediate support could come from the 40-SMA (1298). Slightly below, the 23.6% Fibonacci of 1296 is another major support, while beneath that, the commodity could fluctuate between 1292.67 and 1290.45, where the lower boundary of the Ichimoku cloud is also placed. More losses could send prices until the six-week low of 1280.63, significantly weakening the bullish short-term structure.

To sum up, gold could follow a neutral to positive path in the short term, while in the medium term, the bullish outlook has somewhat faded as in the daily chart the 20- and 40-SMAs are ready to complete a bearish crossover, suggesting a negative structure.