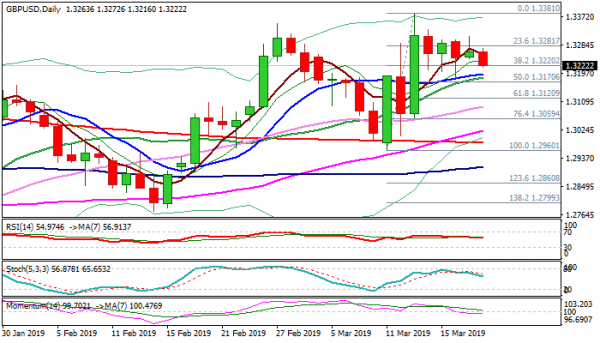

Cable moved lower in early European trading on Wednesday, hitting session low at 1.3225 and pressuring initial pivot at 1.3220 (Fibo 38.2% of 1.2960/1.3381 upleg), following narrow-range action in Asia. Fresh comments about Brexit released this morning, talking about current frustration over parliament’s failure to make a decision and PM May unable to make significant adjustments to her plan, as well as comments about Brexit delay and revived fears of no-deal scenario, pushed pound lower. Volatility rises as all possibilities (no-deal exit on 29 Mar, Brexit extension, parliament’s final approval of the plan, second Brexit referendum) remain on the table and maintain strong uncertainty among traders. The price action of past few days holds in flag-shaped pattern, with north-turning momentum and MA’s bullish setup, maintaining slight bullish tone, but significant upside rejection on Tuesday warns that demand fades. Pivotal supports at 1.3195/84 (converged 10/20SMA’s) stay intact for now and keep in play dip-buying scenario above here. Stronger bearish signal could be expected on sustained break lower that would open way for further easing towards pivotal supports at 1.3120/1.3096 (Fibo 61.8%/30SMA) and risk retest of key 200SMA support (1.2985). Two important releases today are in focus for fresh signals. UK inflation is expected to remain unchanged at 1.8% in Feb (core CPI also at 1.9%), with Fed policy decision being the top event today.

Res: 1.3272, 1.3310, 1.3330, 1.3349

Sup: 1.3195, 1.3184, 1.3170, 1.3120