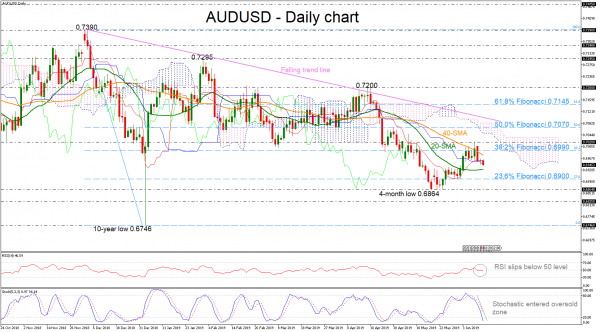

AUDUSD continues to fall below the Ichimoku cloud, remaining in a downtrend over the last six months, stretching its movement towards the 0.6900 psychological level.

According to the RSI, negative momentum could push for further losses in the short-term as the indicator loses steam below its neutral threshold of 50. The stochastic oscillator is also declining, approaching the oversold territory. The price is hovering within the simple moving averages (SMAs) and between the red Tenkan-sen and the blue Kijun-sen lines.

The move could be extended on the downside if the market manages to clear the 20-day SMA and challenge the 23.6% Fibonacci retracement level of the downward wave from 0.7390 to 0.6746 near 0.6900. Breaking this level too, could open the door for the four-month low of 0.6864 and the 0.6825 support.

Should the price climb above the 40-day SMA and the 38.2% Fibonacci of 0.6990, it could then challenge the 0.7020 peak. Further up, the spotlight would turn to the 50.0% Fibonacci of 0.7070, which stands slightly below the descending line.

Overall, the medium to long-term traders who look at the six-month picture continue to face a bear market. The very short-term bias is negative as well after the bounce off the 0.7020 resistance.