Key Highlights

- The Aussie Dollar declined sharply below the 0.6980 support level against the US Dollar.

- AUD/USD traded below a major bullish trend line with support at 0.6955 on the 4-hours chart.

- Australia’s unemployment rate remained at 5.2% in May 2019, whereas the market was looking for a drop to 5.1%.

- The US Initial Jobless Claims for the week ending June 08, 2019 could decline from 218K to 217K.

AUDUSD Technical Analysis

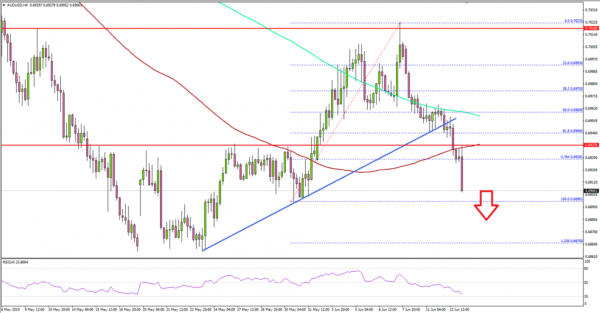

The Aussie Dollar failed again to gain momentum above 0.7000 against the US Dollar. The AUD/USD pair topped near 0.7020 and recently started a major downward move.

Looking at the 4-hours chart, the pair gained bearish momentum below the 0.7000 and 0.6980 support levels. There was a sharp decline after there was a close below the 0.6950 and the 200 simple moving average (green, 4-hours).

The pair traded below a major bullish trend line with support at 0.6955 on the same chart. Moreover, there was a break below the 0.6935 support and the 100 simple moving average (red, 4-hours).

Finally, there was a break below the 76.4% Fib retracement level of the upward move from the 0.6899 low to 0.7022 high. Therefore, there is a risk of more losses in the near term towards 0.6900.

If there is a downside break below 0.6900 and the last low at 0.6899, the pair could decline towards the 0.6870 or the 1.236 Fib extension level of the upward move from the 0.6899 low to 0.7022 high.

On the upside, there are many resistances near the 0.6925, 0.6935 and 0.6940 levels. A successful close above 0.6940 and the 100 simple moving average (red, 4-hours) is must for a decent recovery in AUD/USD.

Fundamentally, the Australian Employment Change figure was released by the Australian Bureau of Statistics. The market was looking for a 17.5K change in May 2019.

The actual result was mixed as the Employment changed 42.3K, but there was no drop in the unemployment rate from 5.2% to 5.1% (as per the market forecast).

The report stated that:

Employment increased 42,300 to 12,868,200 persons. Full-time employment increased 2,400 to 8,792,900 persons and part-time employment increased 39,800 to 4,075,400 persons.

Overall, the market did not like the outcome, resulting in a sharp drop. There could be a final downward push in AUD/USD towards 0.6900 or 0.6870 before it starts a decent upward move.

Economic Releases to Watch Today

- SNB Interest Rate Decision – Forecast -0.75%, versus -0.75% previous.

- US Initial Jobless Claims – Forecast 217K, versus 218K previous.