WTI oil price moved higher and probes above $58 level on Wednesday, after falling 3% Tuesday on news that US President Trump is considering talks with Iran.

Oil price was also under pressure from API report, released late on Tuesday which showed fall in US crude stocks by 1.4 mln bls in the week to 12 July, disappointing forecast for 2.7 mln bls draw and falling well below last week’s – 8.1 mln bls figure.

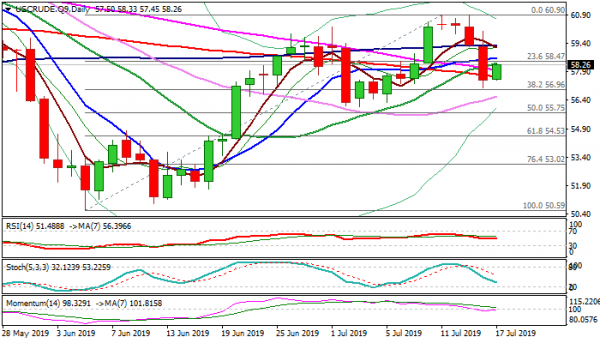

Two day dip from a double-top at $60.90 (which was left after the price repeatedly failed to clearly break above important Fibo barrier at $60.47) accelerated on Tuesday, penetrating thick daily cloud (cloud top lays at $58.59) and ending day below 200DMA ($57.73), but faced strong headwinds from pivotal Fibo support at $56.96 (38.2% of $50.59/$60.90).

Bounce above 200DMA eases negative pressure, however, recovery attempts would require more evidence for generating reversal signal and formation of higher low.

Immediate barriers lay at $58.35/64 (converging 20/10DMA’s), break of which would provide relief, but lift above 100DMA ($59.31) is needed to neutralize bears and open way for renewed attempts at key $60.47/90 barriers.

Daily studies are in mixed mode and traders focus release of US crude inventories report for fresh signals.

Forecast is for 2.6 mln bls draw, which is well below last week’s fall of 9.4 mln bls and oil price is expected react negatively if today’s release disappoints forecast. Firm break below Fibo support at $56.96 would risk test of $56.03 trough (3 July) and $55.75 (50% retracement of $50.59/$60.90 ascend).

Res: 58.35; 58.64; 59.31; 60.00

Sup: 57.65; 56.96; 56.60; 56.03