The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.11448

Open: 1.11545

% chg. over the last day: +0.12

Day’s range: 1.11479– 1.11611

52 wk range: 1.1111 – 1.2009

EUR/USD currency pair began to recover after a prolonged fall. The trading instrument has updated local maxima. At the moment, EUR/USD quotes are consolidating in the range of 1.11350-1.11600. Investors have taken a wait before the Fed’s monetary policy decision. For the first time since 2008, the regulator is expected to cut interest rates. We recommend to pay attention to the comments and rhetoric of the representatives of the Central Bank. Financial market participants will also evaluate a number of important economic releases. Positions must be opened from key levels.

The Economic News Feed for 31.07.2019:

Labour Market Report (GER) – 10:55 (GMT+3: 00);

Consumer Index (EU) – 12:00 (GMT+3:00);

GDP Report (EU) – 00:00 (GMT+3:00);

ADP Nonfarm Employment Change (Jul) (US) – 15:15 (GMT+3:00);

Fed Interest Rate Announcement (US) – 21:00 (GMT+3:00);

Indicators do not provide accurate signals: 50 MA crossed 100 MA.

The MACD histogram is in the positive zone and continues to rise, indicating a further correction of the EUR/USD quotes.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which also indicates bullish moods.

Trading recommendations

Support levels: 1.11350, 1.11150, 1.11000

Resistance levels: 1.11600, 1.11850, 1.12100

If the price consolidates above 1.11600, expect further recovery toward 1.12000-1.12200.

Alternatively, the price can drop toward 1.11000.

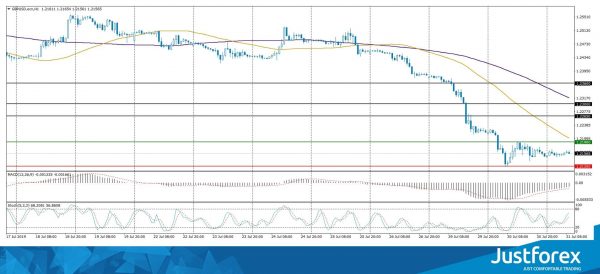

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.23748

Open: 1.22147

% chg. over the last day: -1.28

Day’s range: 1.21182 – 1.22258

52 wk range: 1.2118 – 1.3385

GBP is still under pressure due to the growing risks of hard Brexit. There are aggressive sales on the GBP/USD currency pair. During yesterday’s and today’s trading, the drop in quotes exceeded 230 points. The trading instrument reached two-year lows. At the moment, the key support and resistance levels are 1.21200 and 1.22000. We expect a further decline in the GBP/USD currency pair and recommend to keep track of current information on the issue of Brexit. Open positions from the key levels.

The Economic News Feed for 31.07.2019 is calm.

Indicators signal the strength of sellers: the price has fixed below 50 MA and 100 MA.

The MACD histogram is in the negative zone and below the signal line, which gives a strong signal to sell GBP/USD.

The Stochastic Oscillator is in the oversold zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.21200, 1.20500

Resistance levels: 1.22000, 1.22650, 1.23000

If the price consolidates below 1.21200, expect a further decline toward 1.20800-1.20600.

Alternatively, the quotes can correct toward 1.22500-1.22700.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.31650

Open: 1.31634

% chg. over the last day: -0.03

Day’s range: 1.31560 – 1.31772

52 wk range: 1.2727 – 1.3664

CAD has stabilized after a rather long growth. At the moment, the USD/CAD currency pair is trading in a flat. Local levels of support and resistance are 1.31500 and 1.31800. The financial market participants expect additional drivers. Today we recommend to pay attention to economic reports from the USA. Trading instrument has the potential for further growth. Positions must be opened from key levels.

The Economic News Feed for 31.07.2019 is calm.

Indicators do not give accurate signals: the price crossed 50 MA and 100 MA.

The MACD histogram is located near the 0 mark.

The Stochastic Oscillator is in the overbought zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.31500, 1.31200, 1.30900

Resistance levels: 1.31800, 1.32000

If the price consolidates above 1.31800, expect further growth toward 1.32200-1.32400.

Alternatively, the quotes can drop toward 1.31250-1.31000.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.779

Open: 108.612

% chg. over the last day: -0.17

Day’s range: 108.501 – 108.650

52 wk range: 104.97 – 114.56

The technical pattern on the USD/JPY currency pair is still ambiguous. The trading instrument is consolidating. Currently, the local support and resistance levels are 108.450 and 108.700. Financial market participants expect the Fed to decide on a key interest rate. We also recommend paying attention to the dynamics of US Treasury bond yields. Positions must be opened from key levels.

The Economic News Feed for 31.07.2019 is calm.

Indicators do not give accurate signals: the price crossed 50 MA and 100 MA.

The MACD histogram is in the negative zone, which signals bearish sentiment.

The Stochastic Oscillator is in the neutral zone, the% K line crossed the% D line. There are no signals at the moment.

Trading recommendations

Support levels: 108.450, 108.250, 108.000

Resistance levels: 108.700, 108.900, 109.250

If the price consolidates below 108.450, the quotes will fall toward 108.000.

Alternatively, the quotes can grow toward 109.000-109.200.