Key Highlights

- The British Pound started a short term recovery from 1.2014 against the US Dollar.

- GBP/USD is struggling to gain momentum above the 1.2180 and 1.2200 resistances.

- The Euro Zone CPI in July 2019 declined 0.5% (MoM), more than the -0.4% forecast.

- EUR/USD could extend losses as long as it is below 1.1150.

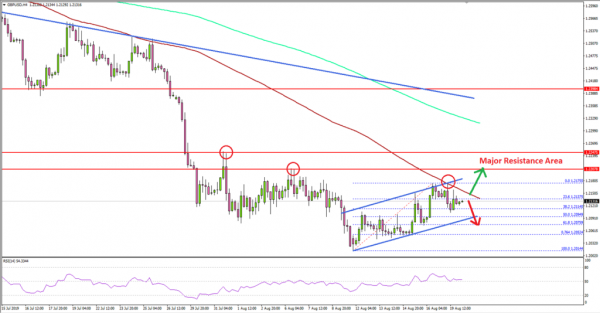

GBP/USD Technical Analysis

Earlier this month, we saw a sharp decline in the British Pound below 1.2200 against the US Dollar. The GBP/USD pair traded as low as 1.2014 and recently started an upside correction.

Looking at the 4-hours chart, the pair recovered above the 1.2100 resistance to start the recent recovery. The pair even climbed above the 1.2150 level, but it seems like the 100 simple moving average (red, 4-hours) capped the upside.

More importantly, the 1.2180 and 1.2200 levels seem to be acting as a strong hurdles (as discussed in the last week’s analysis). The recent swing high was near 1.2175 before the pair corrected below the 1.2150 level plus the 23.6% Fib retracement level of the upward move from the 1.2014 low to 1.2175 high.

On the downside, there is a strong support forming near 1.2080 and 1.2090. If there is a bearish break below the 1.2080 level, GBP/USD could resume its slide towards the 1.2000 support.

Conversely, a clear break above the 1.2200 resistance plus a close above the 100 simple moving average (red, 4-hours) will most likely start a strong rise towards 1.2350 in the coming days.

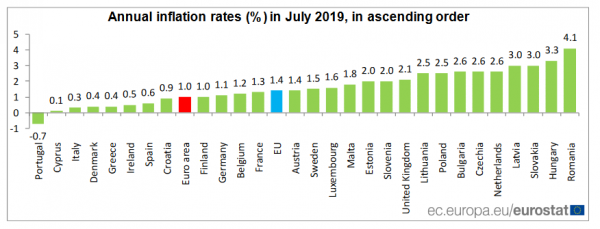

Fundamentally, the Euro Zone CPI for July 2019 was released by the Eurostat. The market was looking for a 0.4% decline in the CPI compared with the previous month.

However, the actual result was disappointing, as there was a 0.5% decline in the CPI (the last reading was +0.2%). Looking at the yearly change, the CPI declined from the last revised reading of 1.3% to 1.0%.

The report added:

In July, the highest contribution to the annual euro area inflation rate came from services (+0.53 percentage points, pp), followed by food, alcohol & tobacco (+0.37 pp), non-energy industrial goods (+0.08 pp) and energy (+0.05 pp).

EUR/USD remained in a bearish zone below the 1.1150 and 1.1160 resistance levels. Overall, the US Dollar remains in control and a strong upward move in EUR/USD and GBP/USD won’t be easy.

Economic Releases to Watch Today

- Euro Zone Construction Output June 2019 (YoY) – Forecast +2.1%, versus +2.0% previous.

- UK’s CBI Industrial Trends Survey Orders August 2019 (MoM) – Forecast -25, versus -34 previous.