Key Highlights

- USD/JPY started a downside correction from the 109.50 resistance.

- There was a break below a contracting triangle with support at 108.90 on the 4-hours chart.

- The US Initial Jobless claims for the week ending Nov 09, 2019 increased from 211K to 225K.

- The US Retail Sales is likely to increase 0.2% in Oct 2019 (MoM), better than the last -0.3%.

USD/JPY Technical Analysis

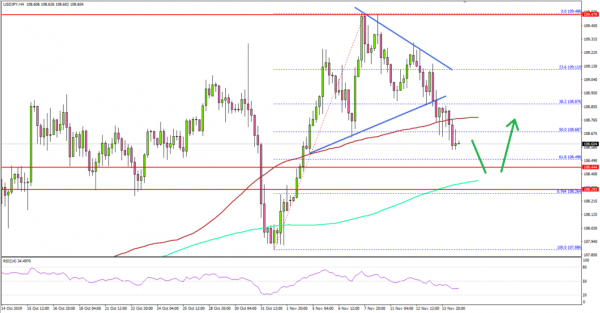

After a strong rise, the US Dollar faced a significant resistance near the 109.50 level against the Japanese Yen. As a result, USD/JPY started a downside correction below the 109.20 and 109.00 support levels.

Looking at the 4-hours chart, the pair settled below the key 109.00 support level and the 100 simple moving average (red, 4-hours). Additionally, there was a break below a contracting triangle with support at 108.90.

More importantly, the pair traded below the 50% Fib retracement level of the upward move from the 107.88 low to 109.48 high. However, there are many key supports on the downside near the 108.40 and 108.25 levels.

The main support is near the 108.25 level since it is near the 76.4% Fib retracement level of the upward move from the 107.88 low to 109.48 high. Should there be a downside break below the 0.9825 support, USD/JPY is likely to revisit the 107.80 support area.

On the upside, the previous supports near the 108.80, 108.90 and 109.00 levels are likely to act as a resistance along with the 100 SMA. If the pair climbs back above 109.00, it could resume its upward move towards 109.50 and 109.80.

Fundamentally, the US Initial Jobless claims figure for the week ending Nov 09, 2019 was released by the US Department of Labor. The market was looking for claims to increase from 211K to 215K.

However, the actual result was disappointing, as the US Initial Jobless claims increased from 211K to 225K. Moreover, the 4-week moving average came in at 217K, up 1,750 from the previous week’s unrevised average of 215,250.

The report added:

The advance number for seasonally adjusted insured unemployment during the week ending November 2 was 1,683,000, a decrease of 10,000 from the previous week’s revised level.

Overall, USD/JPY could correct further lower, but it is likely to find support near 108.40 or 108.25. Besides, EUR/USD and GBP/USD are consolidating losses and they might correct higher.

Upcoming Economic Releases

- Euro Zone CPI for Oct 2019 (YoY) – Forecast +0.7%, versus +0.7% previous.

- Euro Zone CPI for Oct 2019 (MoM) – Forecast +0.2%, versus +0.2% previous.

- US Retail Sales for Oct 2019 (MoM) – Forecast +0.2%, versus -0.3% previous.

- US Industrial Production for Oct 2019 (MoM) – Forecast -0.4%, versus -0.4% previous.