The Aussie dollar rallied further in Asian session on Tuesday after the Reserve Bank of Australia kept interest rates unchanged at record low 0.75% Fresh advance extends previous day’s 0.75% rally, sparked by upbeat China’s data, with short squeeze extending to over 50% of 0.6929/0.6754 descend. The central bank acted in line with expectations, maintaining dovish bias, as today’s statement showed no significant changes from the previous policy meeting’s statement in November.

The RBA said it will continue to monitor the situation and estimate the impact of earlier easing before taking further steps.

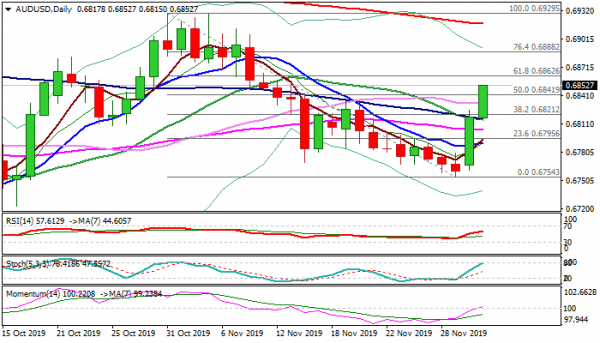

Markets now turn focus towards tomorrow’s release of Australia’s Q3 GDP which will provide more information about the performance of the economy. The pair is up 0.44% since the start of Asian session today and looking for further advance as bullish signals were generated on Monday’s surge through thin daily cloud and today’s extension through cracked Fibo 38.2% of 0.6929/0.6754 (0.6821) and 50% retracement, reinforced by daily Kijun-sen (0.6841).

Daily momentum broke into positive territory, RSI and stochastic are in steep ascend and support the advance.

Caution on strongly overbought 4-hr studies which suggest bulls may take a breather before resuming, but so far without clearer signals.

Broken Kijun-sen (0.6841) offers solid support, with deeper adjustment expected to find ground above 0.6820 zone (broken Fibo 38.2%/converged 20/100DMA’s) to keep bulls in play.

Res: 0.6862, 0.6888, 0.6913, 0.6929

Sup: 0.6841, 0.6832, 0.6821, 0.6805