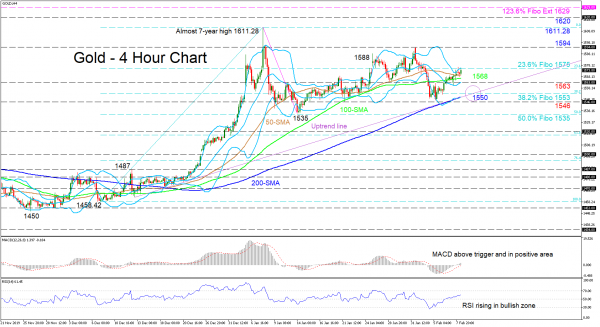

Gold’s gradual incline – after reversing ahead of the 1,546 low – appears to have stalled between the 50-period simple moving average (SMA) and the upper-Bollinger band residing at the 23.6% Fibonacci retracement of the up move from 1,458.42 to 1,611.28.

The short-term oscillators reflect improving positive momentum. The MACD, above its red trigger line, has risen above the zero mark, while the RSI is increasing in the bullish territory. Moreover, all SMAs have kept their bullish picture intact.

A move back below the immediate 50- and 100-period SMAs around 1,568, could find initial friction at the mid-band coupled with the 1,563 support. Moving underneath this, a key support area from the 38.2% Fibo of 1,553 – where the uptrend line drawn from 13 December 2019 also lies – until the 1,546 swing low, which also encompasses the 200-period SMA joined with the lower-Bollinger band, could prevent further declines. Clearing this significant barrier, including the ascending trendline, the yellow metal could drop towards the 50.0% Fibo of 1,535, coinciding with the trough from January 14.

Otherwise, if buyers manage to climb above the capping upper-Bollinger band and the 23.6% Fibo of 1,575, the price may shoot towards the fresh peak of 1,594. Surpassing this resistance, the almost seven-year top of 1,611.28 could challenge the bulls ahead of the 1,620 high from 26 February 2013. Overhead, the 1,629 level may attract attention, which is the 123.6% Fibonacci extension of the down leg from 1,611.28 to 1,535.

Summarizing, the precious metal has preserved its short-term neutral-to-bullish bias and only a violation below the 1,535 low could put the positive picture at risk.