The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.06560

Open: 1.07030

% chg. over the last day: -0.06

Day’s range: 1.06357 – 1.07867

52 wk range: 1.0777 – 1.1494

The EUR/USD currency pair is traded in a flat. There is no defined trend. Investors are waiting for additional drivers. Currently, EUR/USD quotes are testing key support and resistance levels: 1.06550 and 1.08200, respectively. The spread of the COVID-19 virus still remains in the spotlight. China has recorded a decrease in the number of new cases of coronavirus during the day. The ECB reported that the response to the coronavirus outbreak was sufficient and effective, but the regulator is ready to do more if necessary. Open positions from key levels.

The Economic News Feed for 23.03.2020 is calm.

Indicators do not give accurate signals: the price has crossed 50 MA.

MACD histogram is near the 0 mark.

The Stochastic Oscillator is located in the neutral zone, the %K line is below the %D line, which indicates a bearish sentiment.

Trading recommendations

Support levels: 1.06550, 1.06000

Resistance levels: 1.08200, 1.09550, 1.10600.

If the price fixes above 1.08200, expect the quote to correct toward 1.09000-1.09700.

Alternatively, the quotes could descend toward 1.06000.

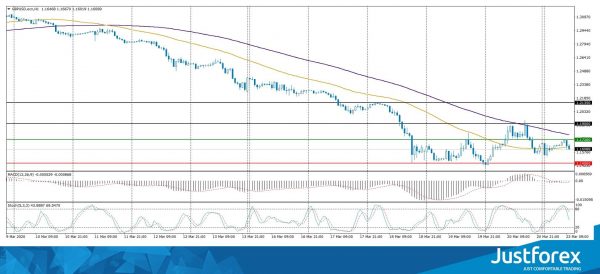

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.14620

Open: 1.16698

% chg. over the last day: +1.35

Day’s range: 1.15275 – 1.17145

52 wk range: 1.1466 – 1.3516

GBP/USD quotes have stabilized after a significant collapse. The pound is now being consolidated. The key support and resistance levels are: 1.14500 and 1.17200, respectively. Investors continue to estimate the impact of COVID-19 virus on the global economy. Technical correction of GBP/USD currency pair is not excluded in the nearest future. Open positions from key levels.

The Economic News Feed for 23.03.2020 is calm.

Indicators do not give accurate signals: the price has crossed 50 MA and 100 MA.

MACD histogram is near the 0 mark.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line which points to a bearish sentiment.

Trading recommendations

Support levels: 1.14500

Resistance levels: 1.17200, 1.19000, 1.21350

If the price fixes above 1.17200, expect a correction toward 1.19000-1.20000.

Alternatively, the quotes could descend toward 1.14000-1.13500.

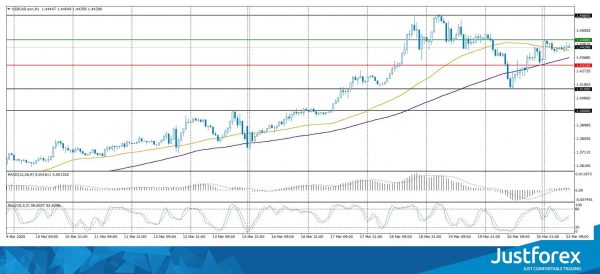

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.45003

Open: 1.43566

% chg. over the last day: -1.02

Day’s range: 1.43507 – 1.44879

52 wk range: 1.2949 – 1.4668

There is a mixed technical picture on the USD/CAD currency pair. At the moment CAD is consolidating. Local support and resistance levels are at: 1.43150 and 1.44900, respectively. Technical correction of the trading instrument after the prolonged rally is not ruled out in the nearest future. We recommend paying attention to the dynamics of oil quotations. Open positions from key levels.

The Economic News Feed for 23.03.2020 is calm.

Indicators do not give accurate signals: the price has crossed 50 MA.

The MACD histogram is in the positive zone, which indicates a bullish sentiment.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which gives a signal to buy USD/CAD.

Trading recommendations

Support levels: 1.43150, 1.41500, 1.40000

Resistance levels: 1.44900, 1.46600

If the price fixes below 1.43150, expect a correction toward 1.42000-1.41000.

Alternatively, the quotes could grow toward 1.46000-1.46500.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 110.888

Open: 110.755

% chg. over the last day: -0.05

Day’s range: 109.668 – 111.251

52 wk range: 101.19 – 112.41

USD/JPY currency pair is in sideways movement. There is no defined trend. Financial markets participants are waiting for additional drivers. At the moment the key range is 109.500-111.450. Technical correction of the trading instrument after a prolonged fall is not ruled out in the nearest future. We recommend you to pay attention to the dynamics of US government securities yield. Oprn positions from key levels.

The Economic News Feed for 23.03.2020 is calm.

Indicators do not give accurate signals: the price has crossed 50 MA.

MACD histogram is near the 0 mark.

The Stochastic Oscillator is located in the neutral zone, the %K line is above the %D line, which indicates a bullish sentiment.

Trading recommendations

Support levels: 109.500, 108.500, 107.850.

Resistance levels: 111.450, 112.000

If the price fixes below 109.500, expect the quotes to correct toward 109.500.

Alternatively, the quotes could grow toward 112.000.