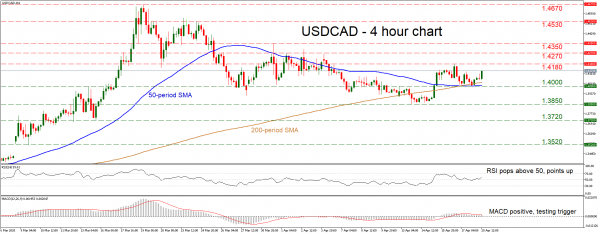

USDCAD recovered somewhat in recent sessions, but the pair is still printing lower highs on the four-hour chart, which keeps the near-term outlook cautiously negative. For the short-term picture to improve to neutral, the bulls would need to push the market above 1.4350.

Short term oscillators suggest that the latest recovery could continue for now. The RSI has crossed above 50 and is pointing up, while the MACD – already positive – is now testing its trigger line, an upside break of which would be a positive signal.

If buyers manage to pierce above 1.4180, their next target might be the 1.4270 zone, which capped upside moves multiple times last month. Moving higher, the focus would turn to 1.4350, where another bullish break would signal that the downside correction that started on March 19 is over. In that case, the 1.4530 area might provide resistance next.

If the bears retake control and push below the 1.4000 handle, the next region to halt losses might be 1.3850. If that’s penetrated too, the short-term outlook would shift to firmly negative, opening the way towards 1.3720.

In short, despite the latest rebound, the near-term picture is still cautiously negative. However, a break above 1.4350 could change that.