Price moves sideways on the short term, is consolidating the latest gains and should climb much higher because the uptrend line remains intact. USD could slip lower again as the USDX could decrease a little as well in the upcoming days.

Right now is trying to recover after the last day’s drop, the Aussie received a helping hand from the Chinese economic data, which have come in better than expected. The Trade Balance climbed from 294B to 321B in July, beating the 294B estimate, while the USD-Denominated Trade Balance increased from 42.8B to 46.7B, exceeding the 45.4B estimate. Moreover, the Australian NAB Business Confidence increased from 8 to 12 points.

The US is to release economic numbers as well today, but I don’t believe that will have any impact on the AUD/USD price action.

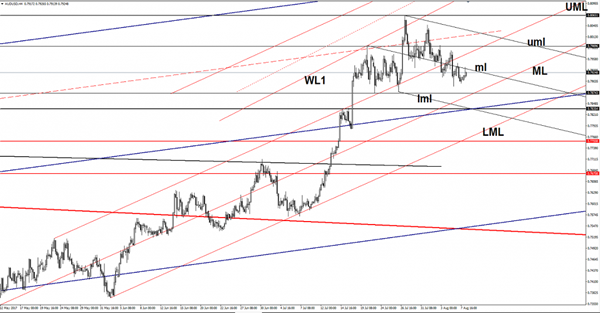

Price increased after the failure to reach the 0.7874 static support and now could pressure the median line (ml) of the minor descending pitchfork. A valid breakout above the median line (ml) will confirm an increase towards the upper median line (UML) of the ascending pitchfork and towards the upper median line (uml).

Continues to move between the 0.8065 and the 0.7874 levels, a breakout from this range will bring us a great trading opportunity. It could drop again, only if the US dollar index will have enough energy to climb much higher in the upcoming period.

USDX decreased a little after the Friday’s impressive rally, could move sideways till will recapture enough directional energy to really start another leg higher.