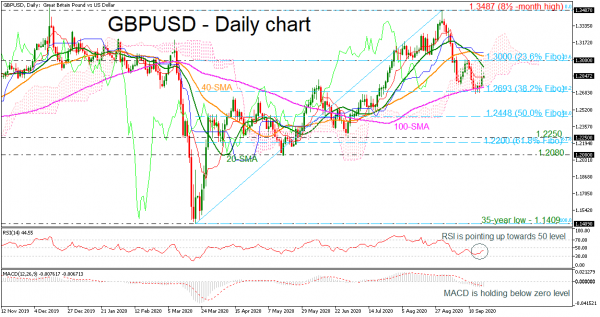

GBPUSD has finally reversed to the upside after the rebound on the 38.2% Fibonacci retracement level of the up leg from 1.1409 to 1.3487 at 1.2693 and the 100-day simple moving average (SMA). However, the downward movement that started at the beginning of September, may not change unless the market manages to crawl substantially above the 1.3000 psychological mark.

The momentum indicators are currently supporting that slightly positive momentum in the very short-term. Specifically, the RSI is picking up speed in the negative territory and the MACD is moving with weak momentum beneath its zero level.

Should the price decisively close above the 23.6% Fibonacci of 1.3000 and the 20- and 40-simple moving averages (SMAs), the bulls could extend the upside move towards the eight-and-a-half-month high of 1.3487. Further advances above this level, could then target the area around the 1.3710 resistance, registered in February 2018.

On the other hand, another decline beneath 1.2693 could meet the 50.0% Fibo of 1.2448. Below that, the pair could reach the 1.2200-1.2250 area, which encapsulates the 61.8% Fibo.

Summarizing, GBPUSD looks positive in the medium-term timeframe following the pullback from the 1.1409 level.