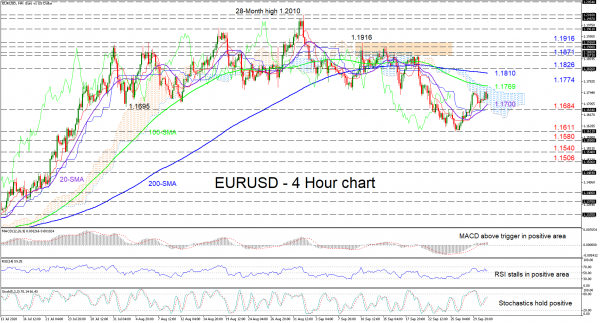

EURUSD is finding difficulty in breaking above the Ichimoku cloud’s ceiling that is joined by the 100-period simple moving average (SMA) around 1.1769. Recently restored positive sentiment from the 1.1611 level appears to be aided by the rising 20-period SMA and the positive tone of the Ichimoku lines.

However, the short-term oscillators reflect mixed signals in direction. The MACD, in the positive area, is slightly above its red trigger line while the stochastic oscillator holds a positive bearing. Meanwhile, the RSI has adopted a directionless demeanour in the positive region. Noteworthy is the fact that the 100- and 200-period SMAs continue to dampen the positive drive in price, and thus could consolidate the pair.

Resistance may originate from the cloud’s roof and allied 100-period SMA at 1.1769. Next, the price may test the tough 200-period SMA currently at 1.1810. Overrunning it, the 1.1826 obstacle may attempt to prevent the price from challenging the 1.1871 to 1.1916 section of congested peaks.

Otherwise, immediate friction may stem from the red Tenkan-sen line ahead of the 20-period SMA at 1.1700 and the low of 1.1684, where the blue Kijun-sen line currently resides. Diving beneath the low, the 1.1611 key trough could draw traders’ focus. More losses may strengthen negative tendencies towards the 1.1580 border. If steeper declines follow, the pair may aim for the 1.1540 and 1.1506 barriers.

Summarizing, EURUSD seems to be sustaining a positive charge above 1.1684. A jump above the cloud and the 200-period SMA may see a neutral-to-bullish bias returning to the short-term timeframe.