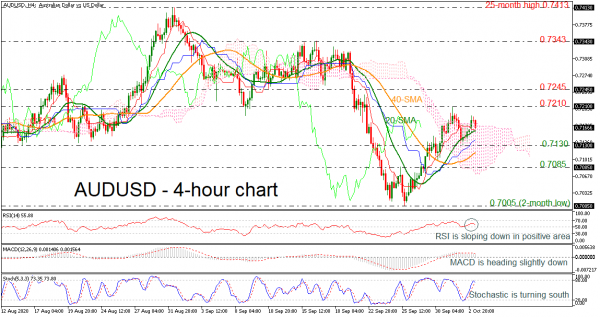

AUDUSD has been recovering nicely after the rebound on the two-month low of 0.7005, crawling back above the 20- and 40-period simple moving averages (SMAs). However, looking at the very short-term the price is ticking slightly down, dropping below 0.7200.

From a technical perspective, the near-term bias is viewed as negative, reflected by the decline in the RSI and the MACD. The RSI is pointing down in the bullish area, the MACD is losing momentum below the trigger line and the stochastic oscillator is ready to post a bearish crossover within the %K and %D lines.

Yet only a decisive close below the 20-period SMA can boost selling pressure towards the 0.7130 support level. Falling further, the 40-period SMA at 0.7115 could be an important level ahead of the 0.7085 barrier. Below that, the bears may haunt the two-month low of 0.7005.

In the event of an upside reversal above the 0.7210 resistance, this may drive the pair towards the 0.7245 hurdle. A successful climb above the latter could bring 0.7343 into play.

In the bigger picture, the market continues to print lower lows and lower highs, holding the negative outlook intact. A fall beneath 0.7005 is expected to trigger the next downside move.