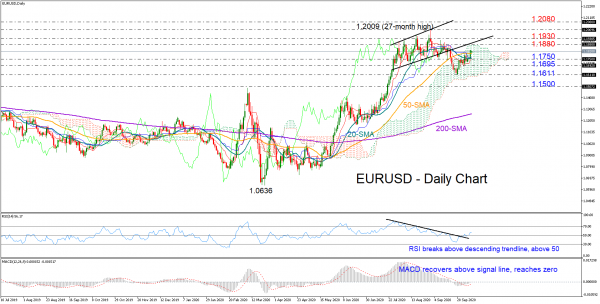

EURUSD opened in the green on Monday with scope to maintain Friday’s gains above the 1.1800 number and its 50-day simple moving average (SMA).

The recent strength in the price is justified by the RSI which has terminated its downward stroke and advanced above its 50 neutral mark. The MACD has breached its red signal line and is set to enter the positive area, reflecting an improving bias as well.

Still, in terms of the trend, the pair continues to hold a downward direction below the 1.2009 peak despite its latest rebound, keeping some caution in place. A rise above the 1.1880 resistance and a bounce back into the broken ascending channel could eliminate fears of a down-trending market, especially if the pair manages to close above the 1.1930 key barrier too. In this case, the bulls may attempt to resume the March uptrend above the 1.2009 top and pierce the 1.2080 level, which has been somewhat restrictive to upside movements during the 2017-2018 period.

On the flip side, a drop below 1.1800 may retest the 1.1750-1.1695 supportive region, a break of which would open the way towards the bottom of the Ichimoku cloud and the previous low of 1.1611. A decisive step lower would give full control to the bears and worsen the short-term outlook, with the 1.1500 mark likely coming next under the spotlight. Another negative extension at this point will then deteriorate the medium-term picture from positive to neutral.

In brief, EURUSD is showing appetite for additional bullish actions in the short-term. However, any optimism that the pair may stretch the March uptrend to fresh highs could be premature unless the price recovers above 1.1880.