EUR/USD

Current level – 1.1838

With the appreciation of the euro, the currency pair managed to breach the important resistance at 1.1825, confirming the bullish sentiment. The rally was mainly driven by the optimistic mood surrounding the negotiations for additional fiscal stimulus which, if delivered, will lead to a further depreciation of the U.S. dollar. The next more significant resistance for the currency pair is found at the 1.1880 level.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1880 | 1.2000 | 1.1825 | 1.1745 |

| 1.1935 | 1.2100 | 1.1790 | 1.1700 |

USD/JPY

Current level – 105.36

The ongoing negotiations for additional fiscal stimulus by the U.S. government have led to a depreciation of the dollar across the board and USD/JPY is not an exception. At the time of writing, the currency pair is facing a test of the support zone at 105.31. A positive development on the negotiations front would be a sufficient factor to breach the mentioned support level and to continue the movement down to the main support area of 105.00.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 105.51 | 106.02 | 105.30 | 104.40 |

| 105.77 | 107.20 | 105.00 | 103.00 |

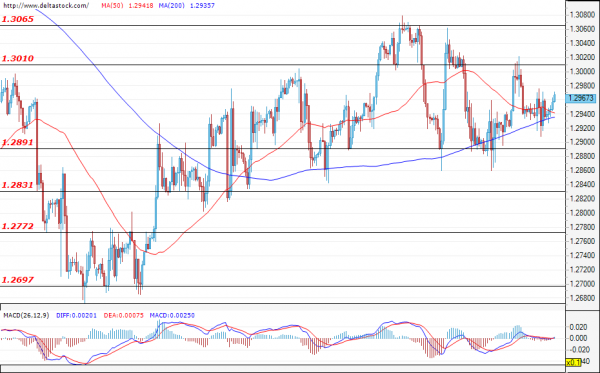

GBP/USD

Current level – 1.2967

The currency pair continues to trade within the narrow range of 1.2890 – 1.3010 and, at the time of writing, the sentiment is rather positive, for a test of the upper limit of the mentioned range. A breach of any of the borders alone would not be a sufficient signal to determine the mood of investors. Instead, we can expect confirmation upon violation of the following levels:1.3065 in the positive direction and 1.2831 in the negative direction. As with the other currency pairs involving the USD, market participants will closely monitor the final day of negotiations on behalf of the U.S. government to receive additional fiscal stimulus.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3010 | 1.3100 | 1.2890 | 1.2770 |

| 1.3065 | 1.3146 | 1.2831 | 1.2700 |