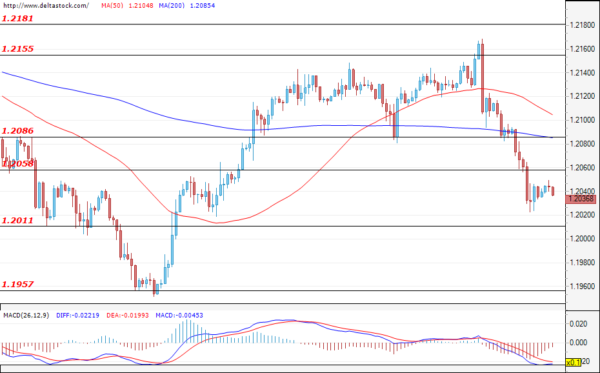

EUR/USD

Current level – 1.2036

During yesterday’s trading session, the currency pair consecutively violated the two support levels at 1.2086 and at 1.2058. The forecast is for the pair to test the next support level of 1.2011. A possible breach of this level would deepen the correction and give the buyers an opportunity to enter the market below 1.2000. Alternatively, in case the support at 1.2011 holds, then the pair would quickly regain positions and reach levels of above 1.2086. Today, investors’ attention will be focused on the CPI data for the eurozone (10:00 GMT) and on the initial jobless claims for the U.S. (13:30 GMT).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2058 | 1.2155 | 1.2011 | 1.2011 |

| 1.2086 | 1.2200 | 1.1957 | 1.1957 |

USD/JPY

Current level – 105.86

The currency pair managed to stay above the support level of 105.62 after it had previously failed twice to violate the important resistance level of 106.20. The forecast is for the pair to renew the upward movement and to re-test the resistance at 106.20, possibly aiming for another test of the next important resistance at 106.70. The first support is the already mentioned level of 105.62.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 106.20 | 107.02 | 105.62 | 104.59 |

| 106.70 | 107.40 | 105.15 | 104.19 |

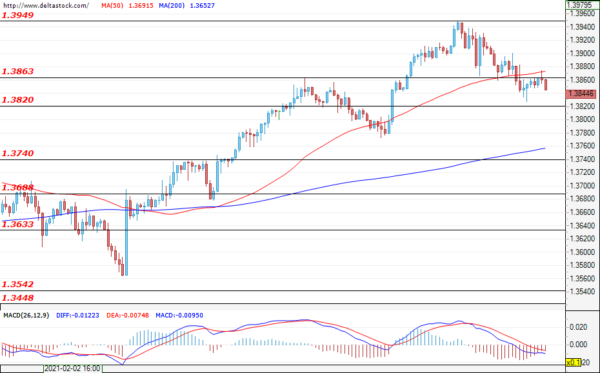

GBP/USD

Current level – 1.3844

The currency pair continues its corrective phase and is currently headed towards a test of the support level at 1.3820. A breach of this support level would deepen the correction and the pair would aim for a test of the support level at 1.3740. If the pair holds above 1.3820, then the upward movement would be restored and the GBP/USD should re-test the resistance level of 1.3949, aiming for the psychological level of 1.4000 and beyond.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3949 | 1.4100 | 1.3820 | 1.3740 |

| 1.4000 | 1.4200 | 1.3740 | 1.3688 |