The dollar remains bid vs yen despite risk aversion on growing Omicron fears and moving in the upper side of near-term range in early trading on Tuesday.

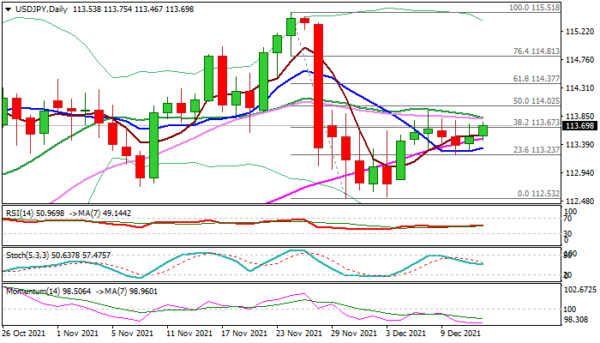

Daily chart shows the action supported by rising and thickening daily cloud (top of the cloud lays at 113.20) and marks solid support which contained dips in past few days.

At the upper side, Fibo barrier at 113.67 (38.2% of 115.51/112.53 pullback) continues to provide strong headwinds as the action in past five consecutive sessions repeatedly failed to register a daily close above this level, keeping the price action within a narrow range, with the upticks being capped by converged 20/30DMA’s (113.82).

Daily studies lack direction signal as negative momentum continues to rise, RSI is neutral and moving averages remain in a mixed setup.

All eyes are on Fed’s policy meeting which ends tomorrow, with high expectations that the US policymakers will be hawkish this time.

Rising inflation, which is more and more unlikely to be a transitory, pressures the US central bank to accelerate preparations for policy tightening, but rising fears about fast spreading Omicron variant and possible consequences it may cause, as well as still unsatisfactory situation in the labor market, could obstruct Fed’s decision.

Look for initial direction signal on break of either range boundary, with violation of upper pivots to (113.67/82) to expose key Fibo levels at 114.02/37 and confirm an end of corrective phase from new 4-year high.

Conversely, break of lower pivots at 113.20 (cloud top) and 112.60 (base) would risk deeper correction of 109.11/115.51 rally.

Res: 113.67, 114.02, 114.37, 114.69.

Sup: 113.55, 113.20, 113.07, 112.53.