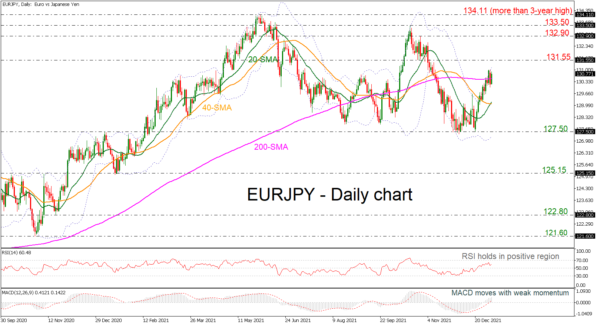

EURJPY has been in a back-and-forth movement around the 200-day simple moving average (SMA) after the bounce off the 127.50 support level around the lower Bollinger band. The price has overcome the 20- and 40-day simple moving averages (SMAs), which have just completed a bullish crossover, and the technical indicators are confirming the bullish bias. The RSI is pointing somewhat up in the positive region, while the MACD is strengthening its positive move above its trigger and zero lines.

Immediate resistance could come from the 131.55 barrier taken from the inside swing low at the end of October 2021. If the bulls take the upper hand and continue the recent move, the next target could be the 132.90 and 133.50 barriers.

On the other hand, a decline below the 200-day SMA may open the way for the bullish cross of the short-term SMAs at 129.20. More losses may see the 127.50 latest low ahead of the lower Bollinger band at 127.25. If the pair fails to hold above these levels, then the next target could be 125.15.

In brief, EURJPY has been in a slight descending move since June 1, but in the very short-term, the bias is distinctly bullish.