DXY:

On the weekly, prices have approached a pivot. With RSI at all time high and divergence spotted, we see the potential for a dip from our 1st resistance at 99.183 in line with 78.6% Fibonacci Retracement towards our 1st support at 95.089 in line with 50% Fibonacci retracement. RSI is at levels where dips previously occurred.

On the daily, prices have consolidated in a triple top pattern. We see the potential for a bounce from our 1st support at 97.753 in line with 100% Fibonacci Projection towards our 1st resistance at 99.430 in line with 100% Fibonacci Projection. Prices are trading above our ichimoku cloud support, further supporting our bullish bias. On the H4 timeframe, prices are approaching a pivot. We see the potential for a dip from our 1st resistance at 98.409 in line with 38.2% Fibonacci Retracement towards our 1st support at 97.741 in line with 38.2% Fibonacci retracement. Prices are trading below our ichimoku clouds, further supporting our bearish bias.

Areas of consideration:

- H4 time frame, 1st resistance at 98.409

- H4 time frame, 1st support at 97.741

XAU/USD (GOLD):

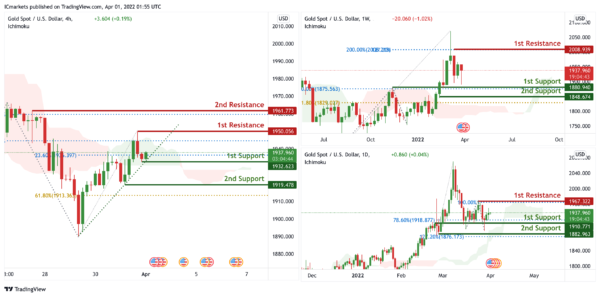

On the weekly, prices are on bullish momentum. We see the potential for a bounce from our 1st support at 1880.940 in line with 50% Fibonacci retracement towards our 1st resistance at 2008.939 which is an area of Fibonacci confluences.

On the daily, prices are on bullish momentum. We see the potential for further bullish continuation from our 1st support at 1910.771 in line with 78.6% Fibonacci retracement towards our 1st resistance at 1967.332 in line with 100% Fibonacci projection. Prices are trading above our ichimoku clouds, further supporting our bullish bias.

On the H4, prices are on bullish momentum and abiding by our ascending trendline support. We see the potential for further bullish continuation from our 1st support at 1932.623 which is in line with 23.6% Fibonacci retracement towards our 1st resistance at 1950.056 in line which is a graphical swing high. Ichimoku is supporting our bullish bias.

Areas of consideration:

- 4h 1st support at 1932.623

- 4h 1st resistance at 1950.056

GBP/USD:

On the weekly, prices are on bearish trendline and abiding by our descending trendline resistance. We see the potential for a dip from our 1st resistance in line with 50% Fibonacci retracement towards our 1st support at 1.30061 which is a graphical swing low and also in line with 127.2% Fibonacci extension. On the daily, prices are on bearish momentum. We see the potential for further bearish continuation from our 1st resistance at 1.32763 in line with 78.6% Fibonacci projection towards our 1st support at 1.30038 in line with 61.8% Fibonacci Projection. Prices are trading below our ichimoku cloud resistance, further supporting our bearish bias. On the H4, prices are consolidating in a triangular pattern. As prices are consolidating in the middle, we would watch for a break from the triangle. Breaking upwards will find prices going to our 1st resistance at 1.31848 in line with 78.6% Fibonacci Retracement. Alternatively, prices may dip towards our 1st support at 1.31043 in line with 78.6% Fibonacci Projection. Technical indicators are showing conflicting views.

Areas of consideration:

- H4 1st resistance at 1.31848

- H4 1st support at 1.31043

USD/CHF:

On the weekly, with price expected to reverse off the stochastics resistance, we expect to see a potential for bearish drop from our 1st resistance of 0.93372 in line with the swing high resistance towards our 1st support level at 0.89358 in line with the horizontal swing low support. Alternative scenario: If price breaks out, it can potentially move towards our 2nd resistance level at 0.94582 which is in line with the swing high resistance.

On the daily, price is expected to reverse off the stochastics resistance, we expect to see a potential for bearish drop from our 1st resistance of 0.93078 in line with the 50% Fibonacci retracement towards our 1st support level at 0.89358 in line with the horizontal swing low support. Alternative scenario: If price breaks out, it can potentially move towards our 2nd resistance level at 0.94134 which is in line with the swing high resistance.

On the H4, with price expected to bounce off the support of the stochastics indicator, we have a bias that price will rise to our 1st resistance at 0.93001 in line with the 50% Fibonacci retracement from our 1st support at 0.92302 in line with the horizontal overlap support and 127.2% Fibonacci extension. Alternatively, price may break 1st support structure and head for 2nd support at 0.91630 in line with the swing low support.

Areas of consideration

- 1st support level at 0.92302

- 1st resistance level at 0.93001

EUR/USD :

On the weekly, we see the potential for a bullish bounce from our 1st support at 1.10710 in line with 78.6% Fibonacci projection towards our 1st resistance at 1.14510 in line with 38.2% Fibonacci retracement. Our bullish bias is supported by the stochastic indicator where it is at support level.

On the daily, we see the potential for a bearish dip from our 1st resistance at 1.11891 in line with 100% Fibonacci projection and 50% Fibonacci retracement towards our 1st support at 1.08030 in line with 61.8% Fibonacci projection and 131.8% Fibonacci extension. Our bearish bias is supported by price trading below the ichimoku cloud indicator.

On the H4 timeframe, we see the potential for a bullish bounce from our 1st support at 1.10609 in line with 78.6% Fibonacci projection and 50% Fibonacci retracement towards our 1st resistance at 1.11886 in line with 100% Fibonacci projection and 61.8% Fibonacci retracement. Our bearish bias is supported by price trading below the ichimoku cloud indicator.

Areas of consideration :

- H4 1st resistance at 1.11886

- H4 1st support at 1.10609

USD/JPY:

On the weekly, prices have approached an all time high. We see the potential for a dip from our 1st resistance at 125.271 in line with 200% Fibonacci Projection towards our 1st support at 118.894 in line with 23.6% Fibonacci retracement. RSI is at levels where dips previously occurred. On the daily, prices are on strong bullish momentum. We see the potential for a bounce from our 1st support at 121.320 in line with 38.2% Fibonacci retracement towards our 1st resistance at 124.312 which is a swing high. On the H4 timeframe, prices have approached a strong resistance. We see the potential for a dip from our 1st resistance at 122.411 in line with 23.6% Fibonacci retracement towards our 1st support at 121.277 in line with 100% Fibonacci Projection. Prices are testing the ichimoku clouds, supporting our bearish bias.

Areas of consideration:

- H4 time frame, 1st resistance at 122.411

- H4 time frame, 1st support at 121.277

AUD/USD:

On the weekly, we see the potential for a bearish reversal from our 1st resistance at 0.75461 in line with 61.8% Fibonacci retracement and 61.8% Fibonacci projection towards our 1st support at 0.69813 in line with 100% Fibonacci projection. Price is trading below the ichimoku cloud indicator, further supporting our bearish bias.

On the daily, we see the potential for a bearish reversal from our 1st resistance at 0.75575 in line with 61.8% Fibonacci projection, 161.8% Fibonacci extension and 50% Fibonacci retracement towards our 1st support at 0.71890 in line with 100% Fibonacci projection. Our bearish bias is supported by the stochastic indicator where it is at resistance level.

On the H4 timeframe, we see the potential for a bullish bounce from our 1st support at 0.74716 in line with 23.6% Fibonacci retracement towards our 1st resistance at 0.75951 in line with 161.8% Fibonacci extension. Our bullish bias is supported by price trading above the Ichimoku cloud indicator.

Areas of consideration

- H4 1st resistance at 0.75951

- H4 1st support at 0.74716

NZD/USD:

On the weekly, we see the potential for a bearish reversal from our 1st resistance at 0.70061 in line with 50% Fibonacci retracement towards our 1st support at 0.65404 in line with 61.8% Fibonacci projection. Price is trading below the ichimoku cloud indicator, further supporting our bearish bias.

On the daily, we see the potential for a bearish reversal from our 1st resistance at 0.69938 in line with 61.8% Fibonacci retracement and 127.2% Fibonacci extension towards our 1st support at 0.67296 in line with 78.6% Fibonacci projection and 50% Fibonacci retracement. Our bearish bias is supported by the stochastic indicator where it is at resistance level.

On the H4 timeframe, we see the potential for a bullish bounce from our 1st support at 0.69188 in line with 23.6% Fibonacci retracement towards our 1st resistance at 070514 in line with 161.8% Fibonacci extension. Our bearish bias is supported by price trading above the ichimoku cloud indicator.

Areas of consideration :

- H4 1st resistance at 0.70514

- H4 1st support at 0.69188

USD/CAD:

On the weekly, with price expected to reverse off the stochastics resistance, we expect to see a potential for bearish drop from our 1st resistance of 1.29626 in line with the swing high resistance towards our 1st support level at 1.23427 in line with the horizontal swing low support. Alternative scenario: If price breaks out, it can potentially move towards our 2nd resistance level at 1.33953.

On the Daily, with price expected to bounce off the support of the stochastics indicator, we have a bias that price will rise to our 1st resistance at 1.28819 in line with the swing high resistance from our 1st support at 1.24737 in line with the horizontal swing low support. Alternatively, price may break 1st support structure and head for 2nd support at 1.23130.

On the H4, with price expected to bounce off the support of the stochastics indicator, we have a bias that price will rise to our 1st resistance at 1.25967 in line with the 38.2% Fibonacci retracement from our 1st support at 1.24617 in line with the horizontal swing low support. Alternatively, price may break 1st support structure and head for 2nd support at 1.23886 in line with the 161.8% Fibonacci extension.

Areas of consideration:

- H4 time frame, 1st support at 1.24617

- H4 time frame, 1st resistance at 1.25967

OIL:

On the Weekly, with price expected to bounce off the support of the ichimoku cloud, we have a bias that price will rise to our 1st resistance at 131.64 in line with the 127.2% Fibonacci extension from our 1st support at 86.84 in line with the 50% Fibonacci retracement. Alternatively, price may break 1st support structure and head for 2nd support at 68.70.

On the Daily, with price expected to bounce off the support of the ichimoku cloud, we have a bias that price will rise to our 1st resistance at 132.14 in line with the swing high resistance from our 1st support at 98.15 in line with the horizontal swing low support and 61.8% Fibonacci retracement.

On the H4, with price moving below the ichimoku cloud, we expect to see a potential for bearish drop from our 1st resistance of 113.70 in line with the pullback resistance towards our 1st support level at 98.14 in line with the 61.8% Fibonacci projection. Alternatively, If price breaks out, it can potentially move towards our 2nd resistance level at 123.24 which is in line with the swing high resistance.

Areas of consideration:

- H4 time frame, 1st resistance of 113.70

- H4 time frame, 1st support of 98.14

Dow Jones Industrial Average:

On the weekly, with price moving above the ichimoku cloud, we have a bias that price will rise to our 1st resistance at 36470 from our 1st support at 32608. Alternatively, price may break 1st support structure and head for 2nd support at 29878 in line with the horizontal overlap support.

On the daily, with price moving above the ichimoku cloud, we have a bias that price will rise to our 1st resistance at 35818 in line with the 127.2% Fibonacci extension from our 1st support at 34051 in line with the horizontal pullback support. Alternatively, price may break 1st support structure and head for 2nd support at 32594 in line with the horizontal swing low support.

On the H4, with price moving above the ichimoku cloud, we have a bias that price will rise to our 1st resistance at 34673 in line with the 127.2% Fibonacci extension from our 1st support at 34059 in line with the horizontal pullback support. Alternatively, price may break 1st support structure and head for 2nd support at 35623 in line with the horizontal swing low support.

Areas of consideration :

- H4 1st support at 34059

- H4 1st resistance at 34673