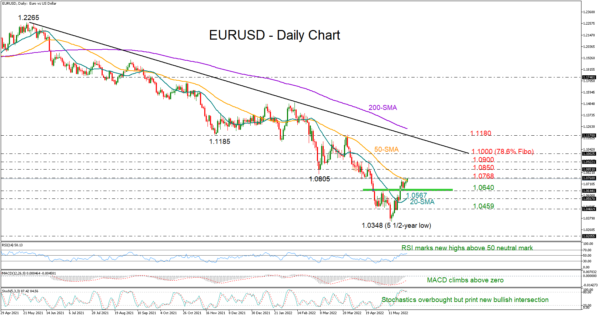

EURUSD opened with low volatility on Monday, remaining muted marginally below the 50-day simple moving average (SMA) and the 1.0768 key resistance level for the fifth consecutive session after securing two bullish weeks.

Despite the ongoing restrictions on the upside, the latest bounce on the former boundary of 1.0640 keeps buying interest alive. The momentum indicators are sending positive vibes as well; the MACD is trying to expand in the positive area for the first time since February, while the RSI is printing new highs above its 50 neutral mark.

Of course, some caution is still required as the Stochastics fluctuate in the overbought territory, though given the progressing positive intersection between the %D and %K lines, any negative correction could come with some delay, helping the pair to gain further ground before the next bearish round.

A decisive close above the 50-day SMA, which triggered the sell-off at the end of March, could initially pause somewhere between 1.0850 and 1.0900. Should the rally pick up steam above 1.1000 too, all eyes will shift to the tentative descending trendline currently seen around the March peak of 1.1180. Notably, the 200-day SMA at 1.1240 is converging towards the same area.

Should the bulls lose the battle at 1.0768, the pair may again seek shelter near the 1.0640 support zone. If that fails to hold, the 20-day SMA at 1.0567 may immediately come to the rescue. Otherwise, the focus will turn to the 1.0459 floor, where any break lower is expected to bring the 5½-year low of 1.0348, and therefore the long-term downtrend off 1.2348 under examination.

Summarizing, EURUSD is maintaining some optimism despite the latest congestion. A successful step above the 50-day SMA may confirm additional upside moves.