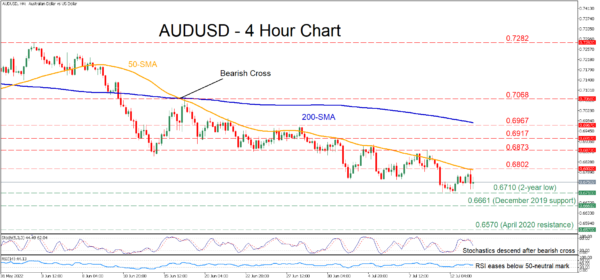

AUDUSD has been experiencing a sustained downtrend, generating a profound structure of lower highs and lower lows. However, in the last few four-hour sessions, the pair has adopted a sideways pattern after it managed to cease its decline at the two-year low of 0.6710.

The momentum indicators suggest that bearish forces remain in control. Specifically, the RSI is flatlining beneath its 50-neutral mark, while the stochastic oscillator is sloping downwards after posting a bearish cross.

If negative momentum strengthens, the price could descend towards its recent two-year low of 0.6710. Should that floor collapse, the pair would extend its decline to form fresh multi-year lows, where the December support of 0.661 could halt any further downside moves. Piercing through this barrier, the spotlight might then turn to the April 2020 resistance of 0.6570.

Inversely, bullish actions may meet initial resistance at the recent peak of 0.6802, which overlaps with the 50-period simple moving average. Jumping above this region, the bulls could aim for 0.6873 before the 0.6917 hurdle appears on the radar. An upside violation of the latter could open the door for 0.6967.

Overall, AUDUSD maintains both its bearish short- and long-term outlooks. For the former to alter, the price needs to decisively cross above the 0.6967 ceiling.