Key Highlights

- USD/JPY declined and tested the key 145.00 support zone.

- A major bearish trend line is forming with resistance near 147.20 on the 4-hours chart.

- EUR/USD surpassed 1.0000 and GBP/USD attempted an upside break above 1.1640.

- The US Gross Domestic Product grew 2.6% in Q3 2022 (Preliminary), up from -0.6%.

USD/JPY Technical Analysis

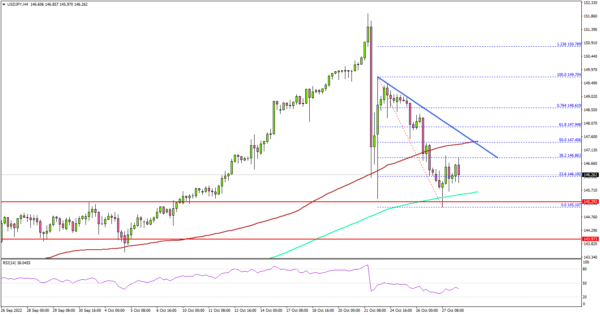

The US Dollar started a major decline after it tested the 152.00 resistance against the Japanese Yen. USD/JPY declined below 150.00 and 149.50 to move into a short term bearish zone.

Looking at the 4-hours chart, the pair gained pace below the 148.00 level and the 100 simple moving average (red, 4-hours). This past week, there was a recovery wave, but the pair failed to climb back above the 150.00 resistance.

A high was formed near 149.70 before there was a fresh decline. The pair declined over 300 pips and tested the 145.00 support zone.

A low is formed near 145.10 and the pair is now consolidating losses. On the upside, it is facing a major resistance near the 147.00 zone. There is also a major bearish trend line forming with resistance near 147.20 on the same chart.

The next major resistance may perhaps be near 148.00 or the 100 simple moving average (red, 4-hours). Any more gains could set the pace for a move towards the 150.00 level.

An initial support is near the 145.70 level and the 200 simple moving average (green, 4-hours). The next major support is near the 145.00 zone. A downside break below the 145.00 zone could push the pair further into a bearish zone.

Fundamentally, the US Gross Domestic Product report for Q3 2022 (prelim) was released yesterday by the US Bureau of Economic Analysis. The market was looking for the GDP to increase by 2.4%.

The actual result was better than the forecast, as the US Gross Domestic Product grew 2.6% in Q3 2022, up from the last decline of 0.6%.

Looking at EUR/USD, there was a move above the 1.0000 resistance, but the pair seems to be losing bullish momentum and might decline below 0.9950.

Economic Releases

- German Consumer Price Index for Oct 2022 (YoY) (Prelim) – Forecast +10.1%, versus +10.0% previous.

- German Consumer Price Index for Oct 2022 (MoM) (Prelim) – Forecast +0.6%, versus +1.9% previous.

- US Personal Income for Sep 2022 (MoM) – Forecast +0.3%, versus +0.3% previous.