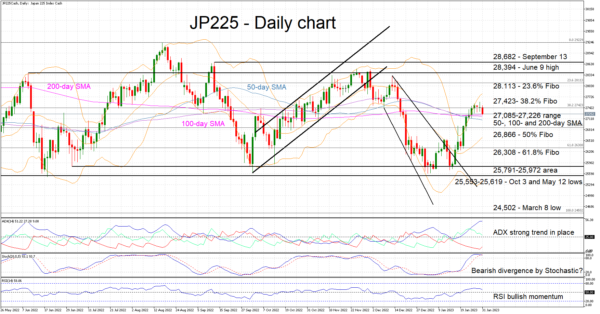

The JP225 cash index is currently testing the 27,085-27,226 area populated by the 50-, 100- and 200-day simple moving averages (SMAs). Today’s dip comes after a strong move recorded since the eve of 2023, that was assisted by the descending broadening wedge that formed in the December 13 – January 17 period.

The momentum indicators appear to be sending a mildly bullish signal, but cracks are forming. The RSI is dipping towards 50 and the Average Directional Movement Index (ADX) signals the presence of a strong bullish trend in the market. Similarly, the stochastic oscillator is at the overbought (OB) territory, making a new higher high. However, this high is not reflected in the JP225 price action thus increasing the chances for a bearish divergence. If we add the convergence of the SMAs, then there is an increasing probability for a sizeable move in the JP225 index.

If the bulls manage to retake the market reins and clear the 38.2% Fibonacci retracement level of the March 8 – August 17 uptrend of 27,423, their first target would be the 23.6% Fibonacci retracement of 28,113. Higher, the twin highs of 28,394 and 28,682 could prove tougher to clear.

Should the bears manage to break the trifecta of SMAs, they could face strong support at the 50% and 61.8% Fibonacci retracement at 26,866 and 26,308 respectively. Even lower, the busier 25,791-25,972 area could be targeted.

To sum up, the JP225 cash index is in consolidation mode after a strong move higher. A break below the 27,085-27,226 area could prove decisive for short-term momentum.