Between October 2022, and January 2023, the Japanese Yen outperformed several other currency pairs, resulting in over a thousand pips move on pairs like EURJPY, GBPJPY, and 2000-plus pips on USDJPY. Considering that the BOJ has recently experienced a leadership change, and the JPY is at a pivotal zone on most charts, it seems a good time to analyze the charts for trading opportunities.

USDJPY

USDJPY seems to be reacting from the trendline support on the daily already. However, as we can see from the chart based on the bearish alignment of the Moving averages, it confirms the possibility of a bearish movement.

Analysts’ Expectations:

- Direction: Bearish

- Target: 129.410

- Invalidation: 135.470

CADJPY

CADJPY initially reacted to a demand zone even though the MAs are inclined in a bearish array. The break of structure, demand zone, and Fibonacci levels point to the possibility of price returning to the supply zone at the 200-Day MA before heading back down.

Analysts’ Expectations:

- Direction: Bullish

- Target: 100.060

- Invalidation: 95.70

EURJPY

I believe the price intends to react from a trendline resistance on the daily timeframe of EURJPY. The fact that the resistance trendline falls in line with the supply zone and 88% Fibonacci retracement zone gives me a reason to believe it would be a great point of entry for a sell order.

Analysts’ Expectations:

- Direction: Bearish

- Target: 145.430

- Invalidation: 137.30

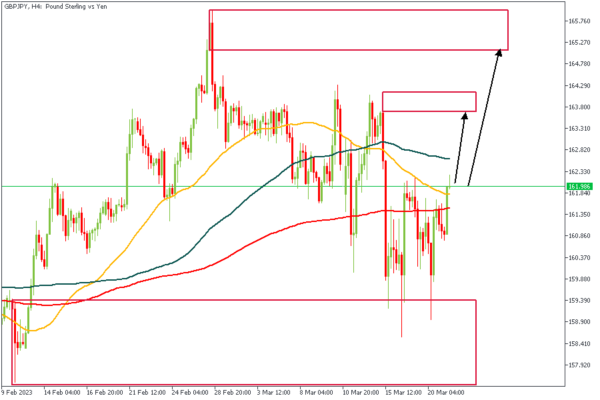

GBPJPY

GBPJPY looks very similar to EURJPY. I see the price heading towards and reacting from either of the two zones I have already marked out. Based on the alignment of the MAs, I will be opting for a sell order from either supply zone.

Analysts’ Expectations:

- Direction: Bullish

- Target: 161.000

- Invalidation: 164.520

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.