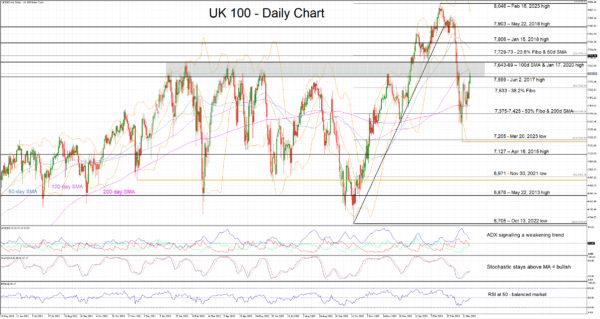

In line with the other main stock markets, the UK 100 cash index is continuing its recovery from the mid-March banking sector-induced dip. The index touched 7,205 on March 20 and it is now hovering just above the June 2, 2017 high of 7,599. It has entered a range that proved difficult for the bulls to overcome during 2022. The market has excellent memory regarding recent highs and hence UK 100 bulls should prepare for this new battle.

In the meantime, a common theme appears to be arising from the momentum indicators, potentially supporting the bulls’ ambitions. The RSI is a tad below the 50-threshold, leaving the door open for another rally. In addition, the stochastic oscillator has managed to remain above its moving average, and it is now staging a bounce higher. This reaction is usually seen as an indication of bullish momentum in the market. The bulls, however, cannot take much encouragement from the Average Directional Movement Index (ADX) as this is dropping aggressively, signaling a weakening trending market.

The bulls would love a break above the 7,689 level set by the January 17, 2020 high, but they have to deal with the 100-day simple moving average (SMA) first. Even higher, the 23.6% Fibonacci retracement of the October 13, 2022 – February 16, 2023 uptrend and the 50-day SMA at the 7,729-7,773 range might trouble them.

On the other hand, should the bears manage to take over the market, they would aim for a retest of the 38.2% Fibonacci retracement at 7,533. The path then becomes trickier as the two heavyweights, the 50% Fibonacci retracement and the 200-day SMA are likely to prove stronger resistance points than currently envisaged by the bears.

To sum up, the UK 100 cash index has quickly recovered from the mid-March shock. But the 7,599-7,689 area would be the true test of the bulls’ resolve.