Australian dollar extends weakness into third straight day, deflated by prospects that the RBA’s tightening cycle is likely at the end.

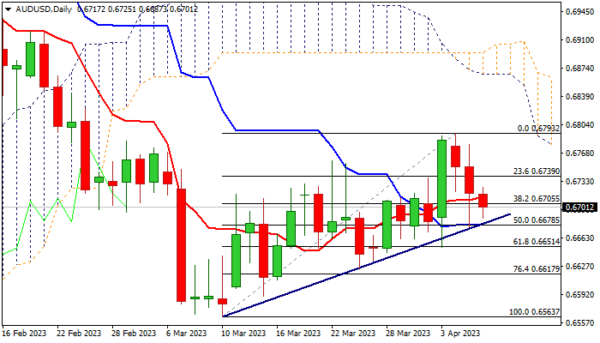

Weaking technical studies on daily chart contribute to negative near-term outlook, as 14-d momentum is about to break into negative territory and thickening daily cloud continues to weigh, though bears need daily close below cracked daily Tenkan-sen (0.6713) to boost signal.

Pivotal support at 0.6678 (daily Kijun-sen/bull-trendline off 0.6563 low/50% retracement of 0.6563/0.6793 upleg) is under pressure and firm break here is needed to confirm bearish signal and open way for further easing towards Fibo levels at 0.6651/0.6617 (Fibo 61.8% and 76.4% respectively) as well as signal top at 0.6793 (Apr 4).

Session high (0.6725) reinforced by 5DMA, marks initial resistance, followed by broken Fibo 23.6% (0.6739) and 200DMA (0.6747) with break of the latter to sideline bears.

Res: 0.6725; 0.6739; 0.6747; 0.6779.

Sup: 0.6678; 0.6651; 0.6617; 0.6589.