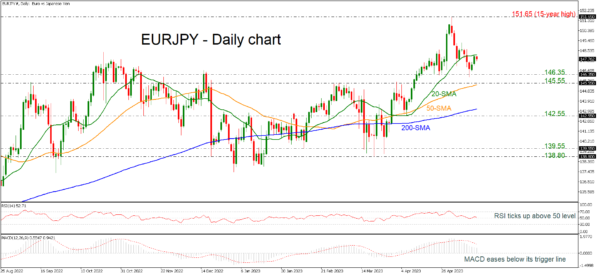

EURJPY is capped by the 20-day simple moving average (SMA) around 148.20 after the rebound off the 146.35 support level.

The short-term bias looks negative as the MACD keeps losing ground below its red signal line, while the RSI seems to be making its way down near its 50-neutral mark.

The 20-day SMA currently at 148.20 could be a trigger point for steeper bullish action if the pair manages to break the line. Higher resistance could run towards the 15-year high of 151.65, registered on May 2 through more buyers could be waiting to enter the 152.00 psychological region.

However, if the pair reverses back to the downside, investors could move first at 146.35 and then at 145.55. If the price continues to drop, support could next come somewhere near the 50- and the 200-day SMAs at 145.35 and 143.13 respectively.

In the near-term picture, the bounce off 146.35 turned the outlook from negative to neutral again. Chances for another bullish move are still rising as the 50-day SMA keeps rising above the 200-day SMA.