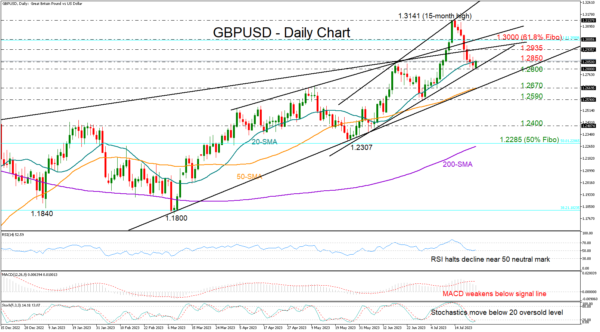

GBPUSD is having a déjà vu of its trendline bounce on June 30, which helped the pair to advance towards a 15-year high of 1.3141 after a tick below the 20-day simple moving average (SMA).

The pair paused its latest bear run near the short-term support trendline from June, but again the technical indicators cannot guarantee a sustained rebound. The RSI has extended its downtrend towards its 50 neutral mark and the MACD remains negatively charged below its red signal line. Hence, although the stochastic oscillator suggests overselling, there’s no proof the bearish correction is done.

The bulls need the price to rise above 1.2850 and then break through the 1.2935-1.3000 zone, which includes two resistance lines and the 61.8% Fibonacci retracement of the 2021-2022 downtrend. A successful penetration of this boundary could clear the way towards July’s top of 1.3140, while higher, the uptrend could stretch as high as 1.3300, last seen in March 2022. This is where the tentative ascending line from June is located as well.

Alternatively, a close below the support trendline at 1.2800 may lead the pair towards its 50-day SMA at 1.2670 and the medium-term ascending line from March. If sellers claim the previous low of 1.2590 too, fears of a negative trend reversal could squeeze the price to 1.2400. Even lower, the spotlight will fall on the 200-day SMA and the 50% Fibonacci of 1.2285.

All in all, GBPUSD maintains a positive trajectory in the short and long-term picture, though whether it will preserve its current bullish momentum remains to be seen.