The dollar index is standing at the back foot on Wednesday, after hitting a two-week high, as traders decided to collect some profits and awaiting fresh signals from the Fed’s decision.

The US Federal Reserve FOMC two-day policy meeting ends today with widely expected decision for 25 basis points hike which will push the interest rate to 5.25%/5.50% range, the highest since 2007/2009 recession.

Today’s decision will mark the eleventh hike in past twelve meetings and likely to signal that the central bank is nearing an end of its hiking cycle, with wide expectations for one more 25 basis points hike until the end of the year.

Faster than expected easing inflation (although is still 2 ½ times above Fed’s 2% target), accelerating economic activity which shows that the US economy is more resilient to rising interest rates than expected and tight labor market (ongoing employment growth and jobless rate at the lowest levels) contribute to scenario of hiking cycle end in the near future.

The central bank shifted its approach to monetary policy from rapid rate hikes to decisions based on meeting-by meeting evaluation of the economic data.

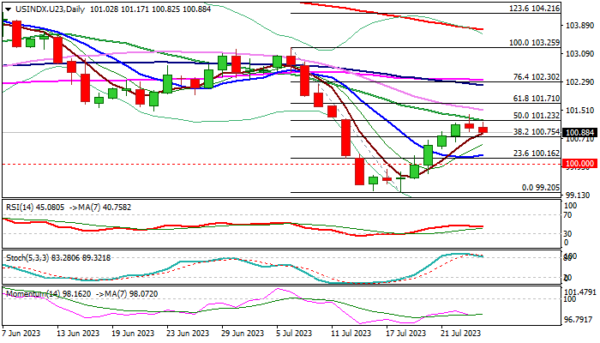

Technical studies on the daily chart show increasing downside risk after the dollar closed in red on Tuesday for the first time in six days and generating an initial signal that five-day recovery rally might be at the end.

Formation of a bull-trap above 101.23 (daily Kijun-sen / 50% retracement of 103.25/99.20 bear-leg) contributes to negative signals from overbought stochastic and 14-d momentum in negative territory, keeping in play the risk of pullback.

Larger picture remains bearish and show broader downtrend from 2022 peak (114.72) intact, with the latest bounce seen as a healthy correction on daily chart and a mild price adjustment on weekly, suggesting that larger bears hold grip.

The dollar is likely to weaken further if Fed keeps its dovish stance, while any more aggressive than expected rhetoric from chief Powell, would offer fresh support to the greenback.

Res: 101.23; 101.37; 101.51; 101.71.

Sup: 100.75; 100.25; 100.00; 99.20.