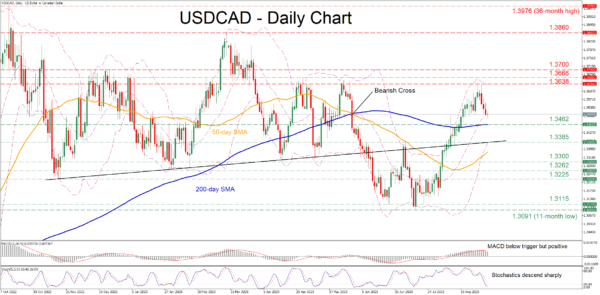

USDCAD had been stuck in a steep uptrend after finding its feet at the 11-month low of 1.3091 in mid-July. However, the pair has been undergoing a downside correction since its rejection at a fresh three-month peak of 1.3638 on Tuesday.

The momentum indicators currently suggest that the bullish forces are fading. Specifically, the MACD is softening below its red signal line in the positive zone, while the stochastics are descending sharply near the 20-oversold mark.

Should the bears attempt to push the price lower, immediate support could be found at the 200-day simple moving average (SMA), currently at 1.3462. Sliding beneath that floor, the pair could retreat towards the May resistance of 1.3385, which might now serve as support. A violation of that territory could open the door for the April bottom of 1.3300 ahead of the February low of 1.3262.

Alternatively, bullish actions could propel the price higher towards the recent rejection region of 1.3638. Surpassing that hurdle, the pair may face the April high of 1.3666 before it marches towards the 1.3700 psychological mark. Further advances could then cease at the 2023 peak of 1.3860 registered in March.

In brief, USDCAD has been losing ground in the last few daily sessions since its latest advance encountered strong resistance at a fresh three-month high. Nevertheless, it’s too early to call for a sustained downtrend, unless the price breaks profoundly below the 200-day SMA.