Gold price rose further on Friday, extending recovery from $1915, where the higher base is forming after three-day fall found firm ground, after being contained by 200DMA.

Weaker dollar on end-of-week profit taking contributed to fresh strength, as the metal benefited from rather neutral stance of Fed policymakers.

Fed officials referred to cooling inflation and quite good shape of the economy, while the latest data showed that labor demand is coming down and unemployment is rising, suggesting that the central bank will likely stay on hold in September’s policy meeting.

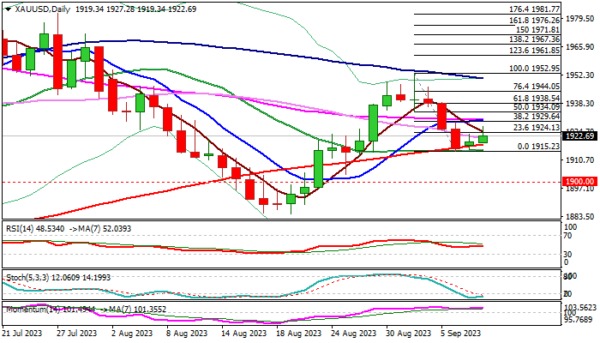

Technical picture on daily chart remains bullishly aligned as positive momentum is strong, RSI heading north and stochastic is about to emerge from oversold territory, though MA’s are in mixed setup.

Fresh strength cracked initial resistance at $1924 (Fibo 23.6% of $1952/$1915) but needs more work at the upside and sustained break above $1930 zone Fibo 38.2% / converged 10/55DMA’s) to generate reversal signal and open way for stronger advance.

Near-term bias is expected to remain with bulls while the price action stays above 200DMA, while next week’s daily cloud twist is also expected to be magnetic.

Res: 1930; 1938; 1940; 1948.

Sup: 1918; 1915; 1902; 1892.