- EURGBP heads for a strong weekly close

- Bull run faces another challenge at 0.8740

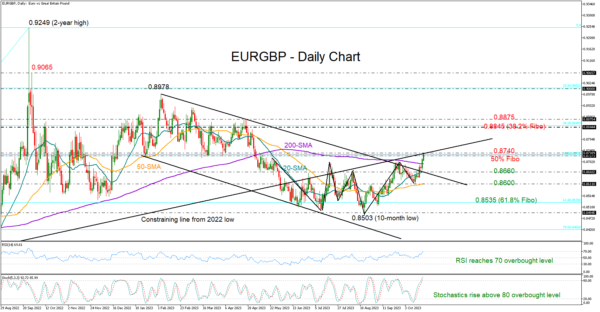

EURGBP recorded a couple of bullish achievements this week, ascending above the resistance trendline, which halted September’s bull run, and crawling above the 200-day simple moving average (SMA) for the first time since May.

The price resumed its bullish momentum on Friday to unlock a six-month high of 0.8736, but the 50% Fibonacci retracement of the 0.8201-0.9249 upleg at 0.8725 might prove challenging as the RSI and the stochastic oscillator hint at strengthening overbought conditions. It’s also worth noting that the upward-sloping line drawn from the 2022 trough came to block the way higher earlier today.

If the recovery continues above 0.8740, it may pick up steam towards the 38.2% Fibonacci level of 0.8850. The 0.8875 barrier from April is within breathing distance and will be closely watched too. Should it prove easy to overcome, the pair could head for the 0.8930 bar.

In the event sellers take over, initial support might develop around the 20-day simple moving average (SMA) at 0.8660 and near the broken resistance trendline. A drop below that base would neutralize the short-term picture, likely motivating another negative correction towards the 50-day SMA at 0.8611. Additional losses from there could aggressively squeeze the price towards the 61.8% Fibonacci of 0.8535.

All in all, EURGBP is looking cautiously bullish in the short-term picture. A decisive close above 0.8740 could bolster buying appetite, whilst a pullback below 0.8660, and more importantly beneath 0.8600, could create fresh selling interest.