- AUDUSD tests the 200-day SMA in narrow range

- Trades sideways after failing to extend its upside move

- RSI and MACD look optimistic

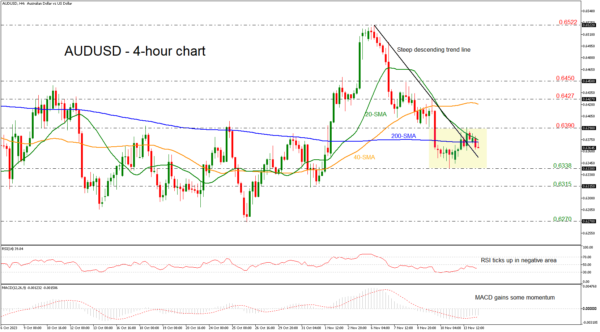

AUDUSD is moving slightly lower today, finding strong resistance near the 200-day simple moving average (SMA), which is acting as a resistance line for the bulls. The pair jumped above the steep descending trend line, which had been holding since the November 6 top of 0.6522, but it is holding within a narrow range of space 0.6338-0.6390.

In the meantime, the momentum indicators are somewhat supportive. The MACD oscillator has managed to jump above its trigger line but is still in a bearish territory, while the RSI is pointing upwards below the 50 level.

Should the bulls push higher, they would try to overcome the 200-day SMA and the 20-day SMA around 0.6370. If successful, they could then touch the 0.6390 barrier before hitting the 40-day SMA at 0.6420.

Alternatively, a drop back beneath the downtrend line would open the way towards the preceding bottom of 0.6338. If the bears clear this area, they could then have the chance to test the 0.6315 support level, registered on October 31.

To sum up, AUDUSD bulls are trying to cancel out the rectangle pattern to endorse the positive scenario in the short-term timeframe.