- ETHUSD forms structure of lower highs and lower lows

- But the latest rebound advances above previous high

- Momentum indicators suggest strengthening positive bias

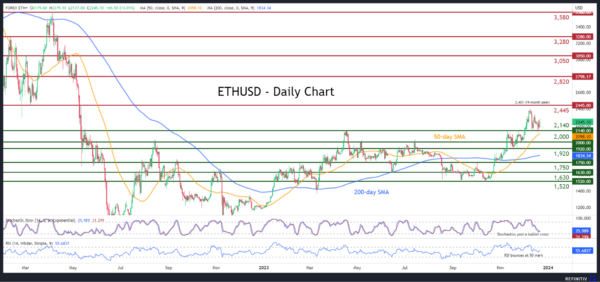

ETHUSD (Ethereum) had experienced a strong rally since late October, which propelled the price to a fresh 19-month peak of 2,403 on December 9. Although the latter was followed by a pullback, the price seems to be attempting a recovery in the past couple of sessions as the short-term oscillators have turned positive.

Should the rebound extend and the price erases the recent correction, initial resistance could be met at the March 2022 bottom of 2,445. If that barricade fails, there is no prominent resistance until 2,820, which has acted both as support and resistance during the first half of 2023. Conquering that region, the bulls might then attack the March 2022 hurdle of 3,050.

On the flipside, bearish actions could send the price to challenge the recent support of 2,140, which also held strong both in April and November. Sliding beneath that floor, the leading altcoin could descend towards the 2,000 psychological mark. A break below the latter may pave the way for the November support of 1,920.

Overall, ETHUSD has just managed to break its structure of lower highs and lower lows as the price jumped above its most recent peak in today’s session. Is this enough to trigger a recovery?