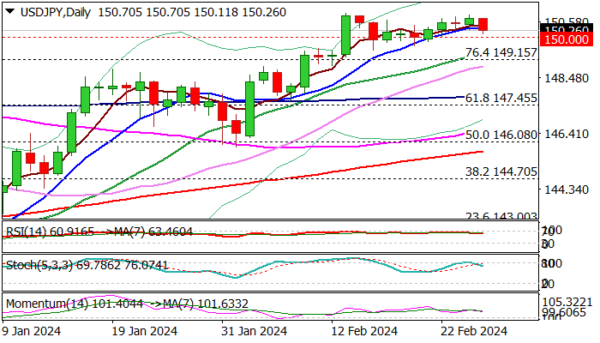

USDJPY eases on Tuesday as traders reacted on overbought daily studies, but dips are likely to be limited and mark a healthy correction of larger uptrend.

Technical picture on daily chart remains bullish (strong positive momentum / moving averages in bullish configuration) keeping in play expectations for final push towards key barriers at 150.90/94 (peaks of 2023 and 2022 respectively).

Bullish outlook is supported by the fact that the pair holds above broken pivotal barriers at 150.00/149.15 (psychological / Fibo 76.4% of 151.90/140.25) for the third week and near-term action is expected to remain biased higher while these supports contain dips.

Initial support at 150.18 (daily Tenkan-sen) has been cracked but so far without clear break, guarding 150.00 level and 149.41/15 (20DMA / Fibo 76.4%).

Only sustained break of 149.15 would neutralize bulls and open way for deeper correction of 140.25/150.88 rally.

A number of economic releases from the US these days (focus is on Q4 GDP and PCE index) are expected to provide fresh signals.

Res: 150.29; 150.64; 150.88; 151.43.

Sup: 150.00; 149.41; 149.15; 148.39.